Consolidated annual report of VP Bank Group

Consolidated results

The year 2016 was characterised by an on-going low to negative interest-rate environment and volatile markets. The regulatory pressure also continued to be high. VP Bank held its ground very well in this demanding environment. The planned synergies arising from the Centrum Bank merger were realised, leading to a marked decline in opera- ting expenses. The adjusted operating income, on the other hand, could be increased. Net new money inflows developed positively.

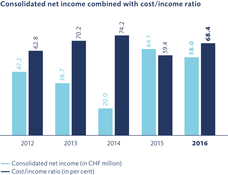

In a challenging stock-market and interest-rate environment, VP Bank Group generated excellent business results in the 2016 calendar year. The 2016 consolidated financial statements of VP Bank Group prepared in accordance with International Financial Reporting Standards (IFRS) report a consolidated net income of CHF 58.0 million.

In the preceding year, a net income CHF 64.1 million had been achieved. This result was positively impacted by the merger with Centrum Bank as well as the non-recurring effect resulting from the application of IAS 19. Excluding these non-recurring items, the 2016 net income was 89.5 per cent or CHF 27.4 million more than the adjusted prior year’s consolidated net income of CHF 30.6 million. Welcome progress was achieved in market-development activities. In 2016, a marginally positive net new money inflow could be reported whereas in the prior year, an outflow of some CHF 658 million had been registered.

Medium-term goals

The Board of Directors of VP Bank Group has defined the following target values for 2020:

- CHF 50 billion of assets under management

- CHF 80 million of consolidated net income

- Cost/income ratio of under 70 per cent

Following the successful merger with Centrum Bank in 2015, VP Bank Group continued to pursue its growth strategy in 2016. Market-development activities could be strengthened and a good client-acquisition performance achieved in VP Bank’s growth markets. Assets under management developed noticeably and profitability was strengthened in a sustainable manner.

VP Bank intends to make further acquisitions of banks or whole teams in its target markets which ideally shall supplement VP Bank Group on the basis of their business model with comparable core competencies, target markets and client structures. In order to advance organic growth, it is planned, as part of a recruitment offensive, to hire some 25 new senior client advisors (with corresponding client assets under management) per annum during the next three years. In addition, as part of the digitalisation strategy, new innovative services are being developed with urgency and targeted investments made in digital tools.

Assets under management at 31 December 2016 totalled CHF 35.8 billion (prior year: CHF 34.8 billion). Consolidated net income for the year ending on 31.12.2016 amounted to CHF 58 million and the cost/income ratio was 68.4 per cent (prior year: 59.4 per cent).

The Management of VP Bank is convinced of achieving the defined goals in 2020 through the targeted exploitation of its organic and acquisition-related growth potential whilst maintaining strict management of costs at the same time. The achievement of the goals is underpinned by the robust level of VP Bank Group’s equity resources which are above average compared to the norm in the industry.

As of 31 December 2016, VP Bank Group possessed a tier 1 ratio of 27.1 per cent and adequate equity to support further acquisitions. On 25 July 2016, Standard & Poor’s confirmed the very good rating of “A–” and raised the outlook from “Negative” to “Stable”. As of 2 March 2017, the outlook was improved again from “Stable” to “Positive”. The high level of equity resources as well as the successful business model of VP Bank Group form an outstanding basis to be able to assume an active role in future in the process of consolidation of banks.

Having regard to the annual results and the balanced long-term dividend policy, the Board of Directors will propose a dividend of CHF 4.50 per registered share A and CHF 0.45 per registered share B to the Annual General Meeting to be held on 28 April 2017.

Client assets under management

As of the end of 2016, client assets under management of VP Bank Group aggregated CHF 35.8 billion. Compared with the prior year’s comparative value of CHF 34.8 billion, this represents an increase of 2.8 per cent.

Compared to the organic development of net new client money in 2015, net new client money inflows during the year showed a marked improvement. Particularly in Asian markets as a result of intensive market-development acti- vities, gratifying net new money inflows could be achieved. In Europe, outflows continued to be recorded against the backdrop of the regulatory environment and taxation-related issues. In aggregate, VP Bank Group recorded net new client money inflows of CHF 7 million in 2016 (prior year: organic net new client money inflows of minus CHF 658 million).

The performance-related increase in assets under management was CHF 978 million in 2016 (prior year: decrease of CHF 2,216 million). This increase is essentially to be ascribed to rising stock-market prices and the rise in the USD and the related upward revaluation of foreign-currency denominated assets under management.

Custody assets declined by 12.2 per cent to CHF 5.8 billion (prior year: CHF 6.6 billion).

As of 31 December 2016, client assets including custody assets totalled CHF 41.5 billion (prior year: CHF 41.4 billion).

Income statement

Operating income

Year-on-year, 2016 operating income declined by 10.9 per cent from CHF 306.6 million to CHF 273.2 million. Excluding the one-off item in the prior year (bargain purchase arising on the merger with Centrum Bank) of CHF 50.0 million, operating income increased by CHF 16.7 million (6.5 per cent).

Through active balance-sheet management as well as margin adjustments and volume increases, interest income could be increased, year-on-year, by CHF 14.0 million, or 15.8 per cent to CHF 102.4 million. Based upon risk/return considerations, client deposits denominated in foreign currencies were, in part, no longer invested on the interbank market but were swapped into Swiss francs using currency swaps and deposited with the Swiss National Bank. Income from the interest component of currency swaps exceeded the expense of SNB negative interest and the reduced level of interest from banks. The increase in interest income from client activities is the result of margin adjustments and volume increases. Interest income on financial instruments valued at amortised cost rose by CHF 0.8 million to CHF 18.6 million principally because of higher balance-sheet positions. Interest income includes also changes in the value of interest-rate hedging transactions in the amount of CHF –2.0 million (prior year: CHF –8.1 million).

Income from commissions and services during the year declined by CHF 7.6 million to CHF 118.8 million (–6 per cent) whereby a positive trend emerged in the 4th quarter of 2016. The volatile market environment reduced the risk appetite of clients leading to a lower level of client activities in securities. Particularly hit was brokerage income which declined by CHF 1.4 million (–4.2 per cent) to CHF 32.3 million. The drop in prices on equity markets occurring in the first half-year of 2016 took its toll on portfolio-based revenues: as a result, commission income from asset management and investing activities recorded a reduction of –12.2 per cent from CHF 46.9 million in the prior year to CHF 41.2 million in 2016.

Fees from investment fund management activities could be increased from CHF 58.5 to CHF 59.4 million (plus 1.5 per cent).

Trading income rose in 2016 by 5.5 per cent from CHF 42.2 million to CHF 44.5 million. Trading on behalf of clients increased slightly by 1.3 per cent to CHF 47.7 million. Realised and unrealised revaluation differences arising from hedging transactions for financial investments are recognised in securities trading. The loss of CHF 3.2 million is slightly better than in the previous year by minus CHF 4.9 million.

Financial investments gave rise to an income of CHF 7.6 million (prior year: loss of CHF 0.7 million). This improvement of CHF 8.4 million is, for the main, the consequence of the discontinuation of the minimum exchange-rate policy against the Euro by the SNB on 15.1.2015 and which had triggered corresponding revaluation losses on foreign-currency positions in the prior year.

The decline on “other income” is to be explained by the non-recurring item in the prior year arising from the Centrum Bank merger. It concerns a gain of CHF 50.0 million relating to the “bargain purchase” arising from the “purchase price allocation”.

Operating expenses

Year-on-year, operating expenses fell in the financial year by CHF 34.2 million from CHF 246.4 million to CHF 212.2 million (reduction of 13.9 per cent).

On the one hand, this reduction fully reflects anticipated benefits of the merger with Centrum Bank and its related non-recurring items which weighed on the expenses of the prior year. The integration of Centrum Bank was completed successfully and realised synergies are already visible in lower operating expenses. On the other hand, a one-off pension-fund-related reduction in personnel expense was recognised.

Year-on-year, personnel expenses increased by CHF 13.4 million, or 11.0 per cent to CHF 135.3 million. The lion’s share of this increase can be ascribed to the non-recurring adjustment to the rate of conversion in the pension fund occurring last year, which reduced personnel expense by a one-off credit of CHF 8.5 million. Compared to 31 December 2015, the employee headcount increased moderately by 3.9 to 738.3 FTEs. In line with the strategic growth initiatives, VP Bank has recruited on a targeted basis and concurrently, eliminated duplications during the merger with Centrum Bank.

General and administrative expenses fell by 14.2 per cent from CHF 60.2 million to CHF 51.7 million in 2016. This decline arises also in connection with the Centrum Bank merger and the related running of parallel operations for a limited period. Synergies were successively exploited with the integration into the existing infrastructure and process landscape and associated costs sustainably reduced. This reduction in expenses manifests itself in the case of external advisory costs in the income-statement caption “Fees” with a reduction of CHF 4.7 million (minus 36.9 per cent) and in “IT systems” with cost savings of CHF 6.2 million.

Depreciation and amortisation as of 31 December 2016 was CHF 15.8 million, or 41.4 per cent less than in the prior year and amounted CHF 22.4 million. This decline reflects principally the non-recurring write-down on intangible assets arising in connection with the Centrum Bank merger in the prior year. In addition, the income statement is no longer burdened by amortisation on the initial capitalisation of the Avaloq banking platform which is now fully amortised.

Charges for valuation allowances, provisions and losses in 2016 amounted to CHF 2.8 million (prior year: CHF 26.0 million). This clear reduction of CHF 23.3 million is to be explained as follows: firstly, a specific valuation allowance had been raised on one client loan in the prior year, and secondly, restructuring provisions had been raised in connection with the Centrum Bank merger and the operational integration of the entities located in Luxembourg.

Taxes on income

Taxes on income in the financial year amounted to CHF 3.1 million which is CHF 7.0 million more than in the prior year in which a minus expense of CHF 3.9 million was recognised. This minus expense arises in connection with changes in deferred taxes as well as the impact of tax-exempted receipts from the Centrum Bank merger.

Consolidated net income

Consolidated net income in 2016 amounted to CHF 58.0 million (prior year: CHF 64.1 million and excluding non-recurring items: CHF 30.6 million). Consolidated net earnings per registered share A was CHF 9.61 (prior year: CHF 10.17).

Comprehensive income

Comprehensive income comprises all revenues and expenses recognised in the income statement and in equity. Items recorded directly in equity principally concern actuarial adjustments relating to pension funds. VP Bank Group generated comprehensive income in 2016 of CHF 46.1 million as against CHF 51.9 million in the preceding year.

Balance sheet

Total assets declined year-on-year by CHF 0.6 billion to CHF 11.8 billion as of 31 December 2016. This decline in total assets is to be explained by the active management of client deposits under “other amounts due to clients”. On the assets’ side, cash and cash equivalents again markedly rose to CHF 3.5 billion (31 December 2015: CHF 3.0 billion) which signifies a very comfortable liquidity situation in VP Bank. As noted under the section on interest income, increased amounts of client monies were deposited with the SNB in order to optimise interest income through the active management of risk and returns. The consequence of this was that amounts due to banks and the related counterparty risks could be reduced by CHF 2.1 billion to CHF 0.7 billion since 31 December 2015.

Client loans in the caption “Receivables from clients” increased during the year by CHF 0.2 billion (4.8 per cent) to CHF 5.2 billion, in particular, as a result of lombard loans. VP Bank continues unchanged its conservative credit-granting policies focusing on qualitative growth in client loans as well as a high level of discipline in credit-granting activities.

At the same time, financial instruments valued at amortised cost rose by CHF 0.2 billion from CHF 1.7 billion in the prior year to CHF 1.8 billion in 2016 (plus 9.5 per cent).

On the liabilities’ side, client deposits (amounts due to clients) and medium-term notes fell since the beginning of 2016 by CHF 0.7 billion (–6.5 per cent) to CHF 10.1 billion as of 31.12.2016. The balance-sheet caption “Debenture bonds” declined year-on-year by CHF 149.2 million to CHF 200.7 million because of the repayment of a maturing bond.

Within the framework of the authorisation granted by the Annual Shareholders’ Meeting of 24 April 2015, VP Bank Ltd launched a further share repayment programme thus picking up from the two successful programmes from 2015. The repurchases of registered shares A which will last from 7 June 2016 through to 31 May 2017, at the latest, are made over the regular trading line of SIX Swiss Exchange. As part of the public repurchase programme, VP Bank Ltd is prepared to repurchase up to a maximum of 120,000 registered shares A. This fact was taken into consideration by the establishment of a corresponding liability which is deducted from equity. The registered shares A so repurchased are to be used for acquisitions or treasury management purposes.

Consolidated equity of VP Bank Ltd at the end of 2016 totalled CHF 936.9 million (end of 2015: CHF 918.1 million). This represents an increase of CHF 18.8 million.

The tier-1 ratio computed in accordance with the Basel III rules at 31 December 2016 was 27.1 per cent (31 December 2015: 24.4 per cent). In comparison with other banks, this is an outstanding value.

Outlook

Unlike the prior year, financial markets have commenced 2017 in a truly friendly manner. The good investor sentiment should, however, be put to the test during the year on numerous occasions. Important elections in several European countries could at least temporarily lead to a return of political risks on financial markets.

2017 will most probably continue to be challenging. This will impact business performance and the results of VP Bank Group.

VP Bank is optimally equipped to meet the challenges of the future and will continue to pursue its sustainable growth strategy. The high level of equity resources and stable shareholder base form a healthy basis to be able to assume an active role in future in the process of consolidation of banks.