How intelligent automation improves the experience of banking customers

Why does a customer decide for a private bank? What distinguishes private banks from each other? The service offering is often comparable and the prices do not play a primary role in private banking.

The greatest distinguishing feature for a bank is the customer experience. But the expectations and habits of customers have changed over the years, and in banking, this is no different. In addition to the telephone and fax machine, the private-banking customer nowadays uses, for instance, e-mail or social messaging to communicate with his advisor and to conduct bank transactions. It is therefore a central task to come to grips with these new behavioural patterns. The goal must be to enthuse with customer experiences. Digitalisation plays a pivotal role on the path to this goal as the former permits a stronger customer orientation and a better satisfaction of individual needs.

Customer experience essentially depends on the following factors: the personal relationship of the client account manager to the customer, the performance on investments, the simple, rapid and correct execution of banking transactions as well as the company profile in the customer’s eyes. In the digital world, the question arises how customer experience can be created at all as the personal relationship using electronic channels is presumably undermined.

Forward-looking software development?

Therefore, banks often try to supplement customer experiences with online services and electronic channels as well as social-media presentations and mobile applications. The success of these measures is often modest. A market study conducted in 2016 by the research institute Forrester Research concluded that the expectations of customers remained unfulfilled especially in the area of mobile banking applications (cf. Forrester’s 2016 Global Mobile Banking Functionality Benchmark), although massively more was invested in IT in the banking industry than in other industries. Forrester sees the reason for this in the fact that banks continue to select, especially in the case of digital customer services, an outdated software-development approach which they adopt from traditional development activities: the new services are developed for an anticipated target state which should remain as stable as possible. This is also reflected in the budgeting for the development of these services: the budget is provided primarily for the initial development stage. As soon as the application is “live”, it is reduced and is limited essentially to the correction of software bugs.

«With the entry into the digital era, a situation has arisen in which stable environmental and organisational forms are no longer the rule but rather the exception.»

In the process, the fact that a much broader idea underlies digital transformation going far beyond the profane use of modern technologies is disregarded: at the core of the transformation lies the understanding that with the entry into the digital era, a situation has arisen in which stable environmental and organisational forms are no longer the rule but rather the exception. Our reality is characterised by ever quicker changing customer expectations, by an increasingly rapidly changing sequence of technological innovations and their assimilation by society.

If an enterprise wishes to exist in the long term in this continually changing environment, it should no longer regard digital technology as a means to an end but as a precondition to be able to cope with this change at all. For a company, digital transformation is no longer a single step to finally regain a phase of stability, but an on-going condition of change whose end today is less predictable than ever.

Flexible processes are demanded

Nevertheless, the present-day banking world continues to be strongly characterised by the idea of stable and structured processes which underlies the conviction that positive economies of scale can be achieved thanks to standardisation. Standardised business processes undisputedly have their place and will continue to do so. However, as a rule, pure business-process solutions in the traditional sense simply do not offer the necessary flexibility to be able to make changes to the process quickly and frequently. But it is precisely this what is required to be able to exist in a perpetual state of digital transformation: processes must be adaptable to changing demands in an uncomplicated and on-going manner and a high degree of individualisation must be possible – this, however, whilst complying with the ever-increasing number of regulations and without an explosion of costs.

«The holding of dialogues and decision-making moves back to the centre of human activities whereas the pure procurement and processing of information is increasingly left to machines.»

Work automation at Appway

The concepts and ideas behind so-called work automation offer a very promising alternative. In the digital age, a new form of automation is becoming increasingly important, which pursues a collaborative approach between man and machine: thanks to intelligent and – in the ideal case – adaptive algorithms, i.e. those which are capable of learning, the machine is able to automatically and continuously extract facts and relationships from data. Appropriately processed, this enables humans to take quicker, sounder and above all, more sustainable decisions – and this without having to be preoccupied with the details of information procurement. The holding of dialogues and decision-making moves back to the centre of human activities whereas the pure procurement and processing of information is increasingly left to machines. Through new user interfaces and artificial intelligence, automation is being further advanced. Machine and man will thus increasingly merge.

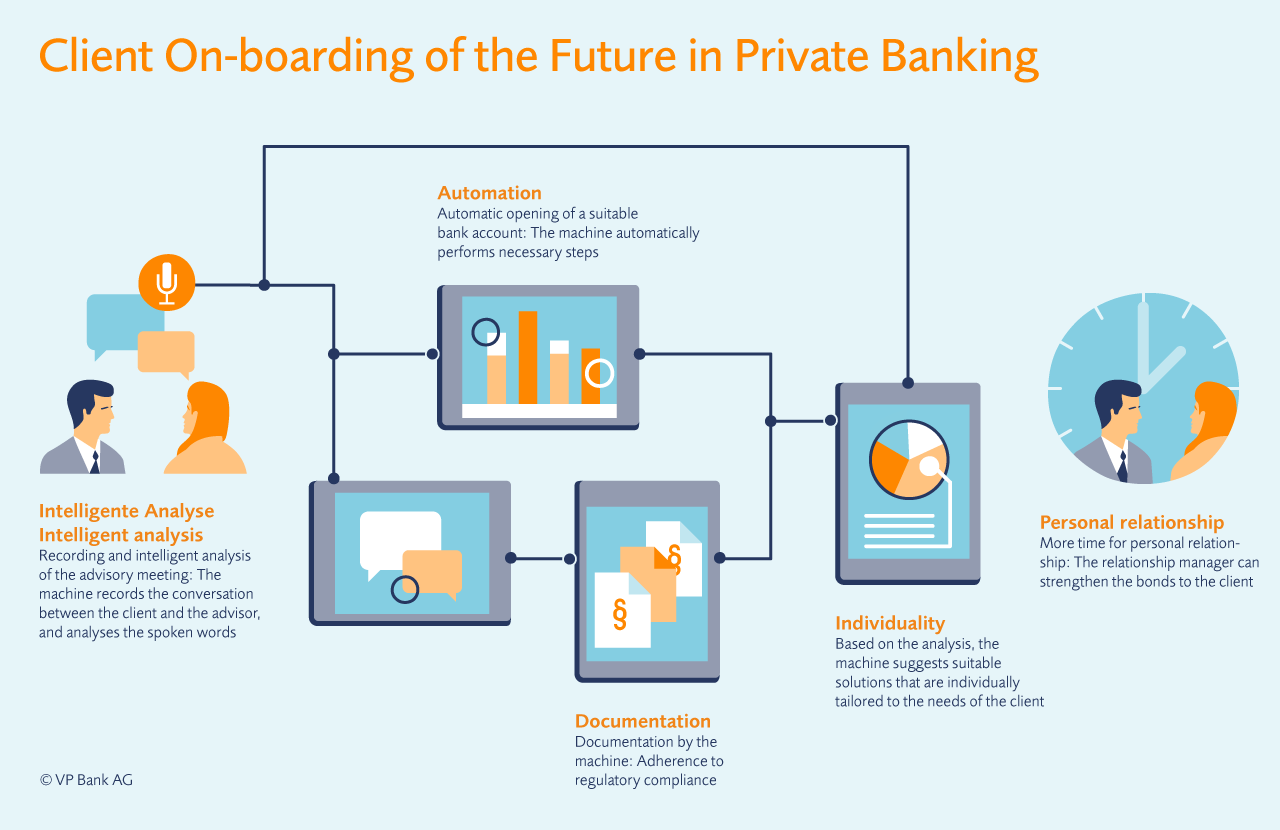

Client onboarding of the future in private banking might then take place in the following way: the computer listens to the conversation between the customer and his advisor. In doing so, it captures and analyses the relevant data, opens the corresponding account automatically and immediately makes a proposal tailored to the customer. In this process, the machine takes regulatory compliance into account. The account officer has more time to get involved with the client and develop a relationship with him.