What Robo-Advisors cannot do

At present, virtual offers are sprouting up from the earth like mushrooms and promise to revolutionise private banking as never before. Pure digital solutions can, however, not satisfy, in an all-embracing manner, the needs of demanding private-banking customers. A hybrid advisory model promises the best of both worlds.

To what extent the classical advisory model, in which the client adviser and the customer interact in the form of a personal conversation, can be modified through virtual advisory models is a justified question. But what exactly are advisory services in wealth management?

The image of the financial world perceived by the individual suggests that everyday life has become riskier and more unpredictable, and the understanding of correlations especially in the world of finance does not necessarily hold true. Advisory services in this context require both specialist as well as communicative and reflexive knowledge. Advisory services do not mean only to master action techniques but are a mix of action-related and reflective competencies to be contextually recreated again and again. It appears important to embrace the multi-faceted dimensions of the term advisory services in order to visualise the term over and above the trivial. In contrast to a pure Markowitz portfolio optimisation which can be described comparatively easily through algorithms, the contents of these advisory services place high demands on the capacity to inter-connect knowledge and apply it to a customer situation with a high degree of specificity.

«Although the use of the internet takes on an increasingly important role in the information-gathering phase, the personal interview remains nevertheless the primary source of information and advice.»

To provide advisory services virtually, it must be possible to map them out in software, algorithms or in another type of expert system. Up to a certain degree, this implies that elements of the service are standardisable. The degree of complexity of advisory services in the finance sector varies a lot. This is also true regarding the degree to which the service can be provided totally virtually. Various conceptional forms of virtual advisory services can be represented.

The classical private banker who meets his customer personally and provides advice thanks to his experience and knowledge represents the basic model. The first stage of evolution of this model is represented by hybrid advisory service models in which the customer relationship continues to be dominated by the customer relationship manager, but the customer can use both personal meetings as well as e-mail, chat functions or video telephony. In addition, the customer has the possibility of using certain analytical or simulation programmes via, for instance, an app or webpage. Foregoing a personal advisor represents a second evolutionary stage. Here, it is an information-processing system that provides the advisory content on an automated basis (robo-advisor). As a consequence, the interaction in this process only occurs over a virtual channel.

The question as to how important the human factor is seems crucial when it relates to advisory services provided to high-net-worth customers. A glimpse at the empirical findings from other consulting sectors which present similarities to the finance sector can assist in this respect. Medical counselling can, for instance, be labelled as being comparable to investment counselling (1.) because of the complexity of the advisory services to be provided, (2.) because of the potential significance of the advisory service for the individual, (3.) because of the great importance attributed to the aspect of trust and (4.) because a multitude of online offers develops. In this respect, although the use of the internet takes on an increasingly important role in the information-gathering phase, the doctor and the personal interview with him remain nevertheless the primary source of information and advice.

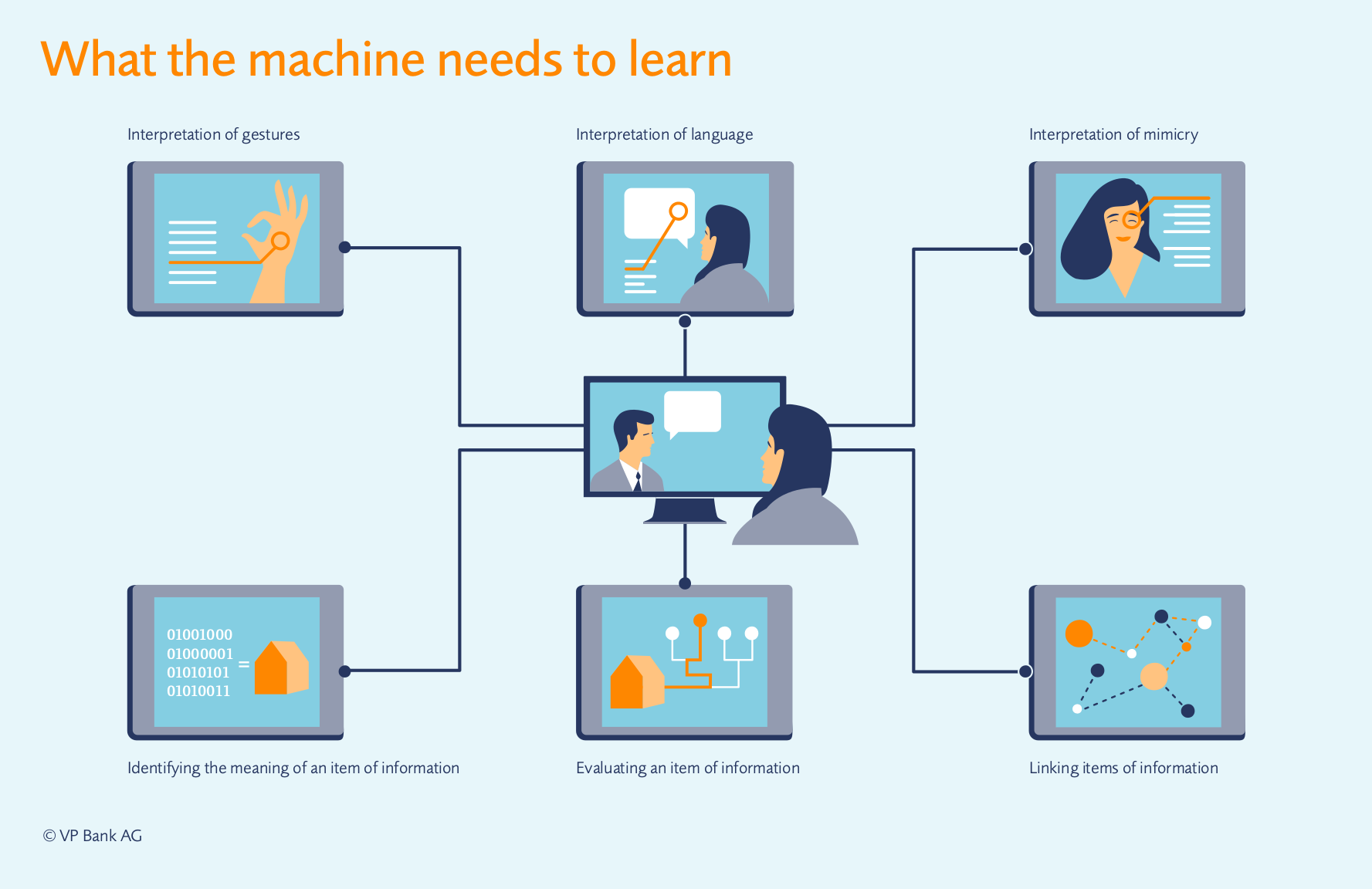

In addition to the deployment of virtual counselling in the field of health, its use in legal advisory services appears to have parallels to financial advisory services. Progress can be recognised also in this area but there are indications that even greater challenges exist when it comes to emulating legal advisory services by means of a machine. Another relevant area of research is human computer interaction (HCI), in which is investigated how trust between man and machine arises or can be enhanced. Here it becomes evident that a long path remains, despite technological progress, before an information system or advisory services via robots will be offered in a form which human beings would use. The challenge here lies both in the level of the content-related information processing (sense of the information, interlinking of information, evaluation of information) as well as in the form of the interaction (speech, gesture und facial-expression recognition).