Corporate governance 2016

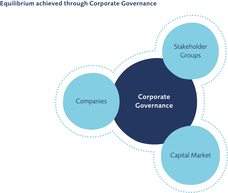

Corporate Governance stands for responsible corporate management and control. The “Swiss Code of Best Practice for Corporate Governance” defines corporate governance as the entirety of principles focused on the interests of shareholders which aim to strike a healthy balance of management and control whilst maintaining decision-making capability as well as efficiency at the highest level of a company and transparency.

Good corporate governance ensures transparent management aimed at sustainable achievement. It is designed to serve not only the company but also external stakeholder groups. The overall framework of corporate governance is determined to a significant degree by the legislator and shareholders; the specific manner in which it is designed is the responsibility of the Board of Directors.

VP Bank Group strives to win the trust of all stakeholder groups. It thus acts in a fair and transparent manner at all times and grants its stakeholder groups insight into its decision-making and control processes. For years, it has thus published, of its own accord, information as to its strategic objectives as well as its relationships with stakeholders.

This report describes the basic principles underlying the corporate management of VP Bank Ltd, Vaduz 1, as required by the revised “Directive on Information Relating to Corporate Governance” (DCG) of the Swiss Stock Exchange, SIX Swiss Exchange dated 1 September 2014 as well as the relevant laws of Liechtenstein.

The regulations of SIX Swiss Exchange stipulate that companies whose shares are listed on the Swiss Exchange but not in their home country must apply the provisions of Art. 663bbis CO by analogy. The respective disclosures are set out under point 5.2 as well as in the notes to the annual financial statements.

Unless otherwise indicated, all corporate-governance disclosures herein are valid as of 31 December 2016.

- Hereinafter referred to as VP Bank.