VP Bank shares

Economic environment in 2015

In terms of the global economy, 2015 had both its highlights and lowlights. Particularly gratifying was the favourable trend in the eurozone economy: certain debt-plagued member states of the common currency region put on a stellar performance. For instance, Spain managed to grow at a 3.2 per cent pace in 2015. On the whole, the eurozone made a good impression and surpassed expectations.

And precisely those better than anticipated developments helped the Swiss economy to absorb at least some of the shock from the dramatic appreciation of the franc following the abandonment of the minimum EUR/CHF exchange rate. But it was mainly the restructuring measures and tighter cost controls at Swiss companies that prevented the local economy from taking a nosedive. On balance, the Swiss economy recorded an annualised 0.9 per cent rate of growth in 2015, which in light of the exchange-rate shock was indeed a laudable achievement.

All the while, the US economy stayed its course: a solid increase in employment gave a boost to consumer spending. The US government also loosened its purse strings this past year, and that helped as well: the US economy expanded by 2.4 per cent in 2015.

The emerging nations, on the other hand, were faced with immense difficulties. The rapid decline in the price of oil and other raw materials in general put a damper on growth in many of the up-and-coming economies. The two emerging heavyweights – Brazil and Russia – took hard hits and fell into a severe recession. Making matters worse for Russia were the sanctions imposed on the country by Western nations. China made for negative headlines mainly due to the collapse in its domestic stock exchanges during the summer months of 2015. Almost forgotten in the fracas was the fact that the Chinese economy, despite the financial market turbulence, remained on target and ultimately grew by 6.9 per cent in 2015.

The inflation rates in the industrialised nations remained stuck at sub-zero levels or at best hovered around nil. Thus the massive year-on-year drop in oil prices clearly left its mark. The flow-through effect was especially noticeable in Switzerland, where the franc’s appreciation pushed the inflation rate even deeper into negative territory: the federal consumer price index fell by an average annual rate of 1.1 per cent – a record. The developments were less extreme in the eurozone and the USA, but the inflation rates remained close to zero in both economic regions. Against this backdrop, the Swiss National Bank (SNB) and the European Central Bank (ECB) carried on with their ultra-lenient monetary policies. With the abandonment of the EUR/CHF exchange rate floor on 15 January 2015, the SNB also reduced its overnight deposit rate to –0.75 per cent. And then in an effort to curb an even further upside move in CHF, the SNB proceeded to intervene relentlessly in the forex market, thereby bloating its balance sheet to enormous proportions.

In January 2015, the ECB introduced a large-scale bond purchase programme. Since March 2015, the ECB has been buying a monthly 60 billion euros’ worth of fixed-income securities issued by public and private entities. Although the Frankfurt central bankers have meanwhile abstained from increasing the monthly purchases, they nevertheless opted in December to reduce the deposit rate from –0.2 per cent to –0.3 per cent. Even though the base lending rate remained in positive territory, the initiation of the securities purchase programme led to an increase in surplus liquidity in the system and hence to negative money market rates. Consequently, banks as well as consumers were faced with an environment of negative interest also in the EUR space.

The US Federal Reserve Bank took the opposite stance. In December 2015, the Fed funds rate was notched up by 25 basis points for the first time in almost a decade. In that the Fed had already made its rate-hike intentions clear months earlier, the actual announcement caused no noteworthy upheavals in the financial markets.

The equity markets in 2015

After the sizeable gains recorded in previous years, 2015 was quite a drag for stock investors who had become so accustomed to success. On average, the share indices for the major industrialised nations managed to close out the year with a modest gain, but the emerging markets were far less fortunate (–15 per cent in USD). At the region-specific level, what in part were enormous divergences opened up: for instance, Japan (+10 per cent) and the eurozone (+11 per cent) came away the clear winners, while the already weak performance in the emerging markets was exacerbated further by the malaise in Latin American countries.

The first half of 2015 was still characterised by rising stock prices. The erstwhile omnipresent Greece crisis lost a bit of its bite at least in the media, and that led to a significant improvement in European investor sentiment. That positive underlying mood, combined with an expansive and reliable monetary policy, allowed the DAX to soar almost 24 per cent by mid-April. Also in Japan, monetary policy was the source of clear and pivotal stimuli which enabled the Topix to surmount the +30% mark in just the first three months of the year.

But after the euphoric first semester, sobriety returned in the second half of the year. Concerns about a growth slowdown in China caused the already heavily margined Chinese stock markets to collapse and led to heighted risk aversion across the globe. Moreover, the fundamentals no longer offered any substantial help. The waning price of crude oil had such a negative impact on earnings in the energy sector that the overall US market registered its worst annual performance since 2008. The waves of selling in August and September 2015 erased almost all of the previously achieved price gains.

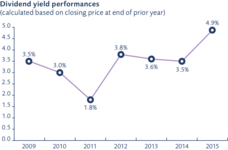

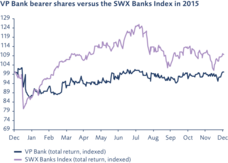

The shares of VP Bank

By having recorded a gain in value of 0.08 per cent (incl. dividend) for the year, the shares of VP Bank marginally underperformed the overall domestic stock market (Swiss Performance Index). VP Bank distributed a dividend of CHF 3.00 per bearer share on an average stock price for the year of CHF 79.90. Hence the dividend yield of 4.9 per cent exceeded that of the overall market and the banking sector per se. Both the high and the low price for the year were recorded in the month of January at CHF 87.50 and CHF 71.15, respectively.

Investor relations

The goal of VP Bank’s investor relations efforts is to foster an open, ongoing dialogue with shareholders and other capital market participants by providing them with a true and fair view of VP Bank Group, whilst also informing the interested public promptly about the latest developments at the company.

The tasks involved in this investor relations work include conducting discussions with analysts and investors, disclosing ad hoc information regarding business issues of relevance under securities law, producing the company’s annual and semi-annual reports and publishing the related financial results, as well as organising the annual general meeting of shareholders.

In 2015, those investor relations activities also involved the organisation of numerous analyst and press conferences, which were important venues for fostering greater interaction and discussions with investors and financial intermediaries.

In May 2015, the 2nd VP Bank Investor Day was held in Zurich with approximately 30 shareholders, investors and analysts in attendance. Adrian Hasler, Head of Government of the Principality of Liechtenstein, was the prominent keynote speaker at the event.

Regular presentations addressing the current trend in VP Bank’s financial results serve to enhance the dialogue with institutional and private investors. Additional means of communication are the www.vpbank.com website and the online version of the annual report under vpbank.wsc.ch, where all up-to-date information on VP Bank can be accessed. In 2015, the content of the investor pages was reworked and supplemented with additional information.

In its dialogue with investors, shareholders and clients, VP Bank attaches great value to providing the latest information, and this in an extremely user-friendly way. Thus the further evolution of the online version of VP Bank Group’s annual report was accorded special significance again in 2015. For the first time, VP Bank’s full 2015 semi-annual report was also made available online.

A total of three commendations for the online 2014 annual report once again attested to the creativity of VP Bank. In connection with the “Galaxy Award”, the online report of VP Bank received a Gold Award and was named “Best of Category” worldwide in the “Annual Reports Online” grouping. The Galaxy Awards are presented in the USA and in 2015 more than 700 participating companies from 20 countries vied for the honours.

The print version of the VP Bank annual report was also the winner of two international awards. Moreover, a jury comprised of communication and financial professionals ranked VP Bank Group’s publication one of the fifteen best in Switzerland and Liechtenstein as a part of the “Swiss Annual Report Ratings 2015”.

In August 2015, Standard & Poor’s reconfirmed its “A–” (A–/A–2) rating of VP Bank Group, thereby underscoring the Bank’s high creditworthiness. In its report, Standard & Poor’s made special note of VP Bank Group’s outstanding capital base, as well as its stable shareholder structure and steady customer deposits.

This good “A–” rating confirms the solid and successful business model of VP Bank Group. VP Bank is one of the few private banks in Liechtenstein and Switzerland that are evaluated by a major international rating agency.

In 2015, research coverage of VP Bank Group was provided by analysts at MainFirst Bank AG and Zürcher Kantonalbank.

Agenda |

|

Publication of 2015 annual financial results | Tuesday, 8 March 2016 |

53rd ordinary annual general meeting | Friday, 29 April 2016 |

Dividend payment | Friday, 6 May 2016 |

Publication of first-half 2016 financial results | Tuesday, 30 August 2016 |

Publication of 2016 annual financial results | Tuesday, 7 March 2017 |

|

|

VP Bank share details | |

Bearer shares, listed on SIX Swiss Exchange | |

Number of listed shares | 6,015,000 |

Free float | 40.02% |

SIX symbol | VPB |

Bloomberg ticker | VPB SW |

Reuters ticker | VPB.S |

Securities number | 1073721 |

ISIN | LI0010737216 |

|

|

Share-related statistics 2015 |

|

High (05.01.2015) | 87.50 |

Low (22.01.2015) | 71.15 |

Year-end close (final settlement value, 30.12.2015) | 82.00 |

Average price | 79.90 |

Market capitalisation in CHF million | 542 |

Consolidated net income per bearer share | 10.17 |

Price/earnings ratio | 8.06 |

Dividend per bearer share (proposed) | 4.00 |

Dividend yield (net) in % | 4.9 |

Standard & Poor’s rating | A– (A–/Negative/A–2) |

Further information on the capital structure and anchor shareholders of VP Bank can be found in the “Corporate governance” section.

Contact

Tanja Muster · Head of Group Communications & Marketing

T +423 235 66 55 · F +423 235 65 00