VP Bank’s suppliers

The way in which procurement is handled has a considerable influence on a company’s environmental impact, image and, not least of all, its cost structure. When commissioning goods and services, VP Bank considers not only the basic requirements, but also a range of criteria such as ecological standards, quality, energy consumption and waste disposal.

The “Procurement principles of VP Bank” is a directive that establishes guidelines for the way VP Bank conducts its purchasing activities. Transparent ordering criteria, clearly defined requirements for suppliers and uniform supplier evaluations ensure the quality of the procurement process and the relationship with those suppliers.

Centralised purchasing

The Central Purchasing unit at VP Bank supports the specialist departments and project heads in the solicitation and evaluation of offers, as well as in the quality assessment of suppliers. It also defines the preferred partners and suppliers of VP Bank Group. When it makes sense to do so, Central Purchasing concludes framework contracts with suppliers. In collaboration with the given specialist department, it defines specific procurement criteria for selected products that may also involve sustainability aspects.

The ecological principle of “Avoid, Reduce, Recycle” is observed in VP Bank Group’s purchasing practices. If they offer comparable characteristics at the same conditions, goods that are especially environmentally friendly or come from environmentally certified producers are given preference.

VP Bank’s suppliers are urged to voluntarily propose environmentally friendly alternatives. They are also required to deliver only merchandise and goods that are in keeping with Liechtenstein’s environmental laws and come from countries that comply with the conventions of the International Labour Organization (ILO).

These conventions establish minimum standards for the observance of human rights, equal opportunity (nationality, gender), working conditions (health and safety at work, wages), child labour, environmental pollution, etc.

Supplier selection

The main criteria in VP Bank Group’s selection process are price, performance, specification-consistent product quality, creditworthiness, conformity with the law and adherence to environmental and social standards. In this regard, VP Bank Group attaches great value to regional procurement: in cases of equivalent offers (price, quality), preference is given to local suppliers and manufacturers. In terms of printing services, VP Bank works primarily with partner companies that print in a climate-neutral way. In the procurement of shareholder gifts, sustainable suppliers from the surrounding region are worked with – for example, the Health Education Center of the Principality of Liechtenstein (HPZ). VP Bank also uses this institution for packaging purposes.

Supplier relations

To optimise its supply chain, VP Bank Group maintains a constant dialogue with its suppliers. For larger orders, specification sheets are drawn up and discussed with the suppliers. Suppliers that have not won the bid for large-scale orders are informed of this either in writing or by telephone. In both instances, the reasons for the negative decision are explained openly.

The suppliers are periodically assessed according to the following criteria: price/performance, quality, reliability, social and environmental compatibility and observance of delivery dates. Upon request, the results of the assessment are discussed verbally with the supplier.

In order to preserve objectivity and avoid conflicts of interest, employees of VP Bank Group may not accept any monetary rewards, gifts imposing an obligation, or other forms of remuneration from suppliers and service providers in connection with their professional activities. This applies from an amount of CHF 200 per supplier per year.

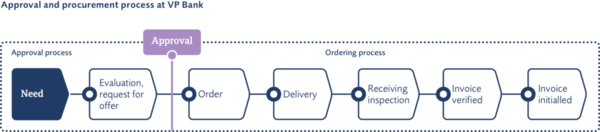

As a way of heightening efficiencies and reducing duplicated work processes, a project was initiated in 2015 with the aim of electronically compiling supplier invoices. Thanks to this high degree of automation, dual filing systems have been eliminated and payment approvals are obtaining significantly more expeditiously. In addition to the savings effect of a paperless workflow, VP Bank also benefits from the ability to meet payment deadlines in good time. These new processes will be launched in the second half of 2016.