VP Bank’s clients

VP Bank Group renders comprehensive, personalised services for private individuals and financial intermediaries – from portfolio management to investment advice, credit facilities and fund solutions. Thanks to what is referred to as open architecture, our clients benefit from the “best manager principle” when selecting third-party investment funds: the asset managers selected by VP Bank continuously rank amongst the top performers in the industry, have an outstanding reputation and enjoy the trust of market participants. As a result, the highest possible security is afforded by the “best manager funds”.

Taken into consideration in VP Bank’s recommendations are the products and services of leading financial institutions as well as VP Bank’s own best-performing investment solutions.

A clearly defined allocation of the roles involved in client care ensures fine-tuned interaction between the client advisors and specialists in the fields of investment products and services, taxes, credits, funds and legal entities such as trusts and foundations. As a part of the holistic approach to investment advice, VP Bank’s teams can draw on Group-wide competencies in order to design bespoke solutions that fulfil all the client’s requirements. The importance of interdisciplinary collaboration is steadily increasing as the clients of VP Bank are faced with ever more complex issues.

In 2015, VP Bank Group again invested considerable sums in enhancing the quality of client advice as well as in intensifying its market cultivation efforts and optimising the structures at all of the Bank’s international locations. Increased client acquisition activities resulted in remarkable successes especially in Switzerland and Asia.

In connection with the Bank’s intensified focus on specific target markets and client segments, a programme was launched in 2014 with the aim of redefining the client segments. Along with this reorientation, VP Bank developed customised service models and refined them even further in the past year.

In that the entire VP Bank organisation is now more clearly focused on the client business, the “Commercial Banking” organisational unit was restructured in 2015. Through the separation of client contact activities and credit administration, VP Bank’s client advisors can now concentrate fully on providing advice. This redoubled client orientation has resulted in the heightened quality of the Bank’s services.

Client satisfaction

VP Bank Group focuses squarely on closeness to the client and service quality. For that reason, the Bank conducts client feedback management activities that include regular surveys of client satisfaction and systematic reporting. Open feedback paths, professional complaint management and a continuous dialogue with clients are evidence of this resolute client orientation.

Within the scope of this ongoing client dialogue process, each year VP Bank receives and addresses close to 500 comments from its clients. In 2015, two-thirds of that feedback was of a positive nature and pertained to the quality of client care.

Client satisfaction was also confirmed in the public domain: Germany’s business and finance journal “Fuchsbriefe” each year examines the quality of advice provided in the areas of private banking and private wealth management. In 2015, VP Bank was once again rated “Recommendable”. Also, Germany’s “Elite Report” in November 2015 distinguished VP Bank with its “Cum Laude” certification.

Business fields and client segments

Through its Private Banking and Intermediaries business units, VP Bank addresses a defined and limited number of target markets and client segments. Private banking services and the intermediaries business are performed at all VP Bank locations. In Liechtenstein and the neighbouring region, this range is supplemented by retail banking services that include client-oriented package solutions.

VP Bank also caters to institutional clients and regional companies in need of capital-spending and operating finance mainly in Liechtenstein and Eastern Switzerland. All these clients benefit from user-friendly, innovative solutions in the areas of e-banking and mobile banking. Youth packages for students and trainees round out the range of services on offer. Moreover, in 2015 three new banking packages were introduced. They include the most important banking services associated with the topics of savings, debit/credit cards and online banking. Clients benefit from modern solutions, attractive prices and uncomplicated ways to conduct their banking business.

New challenges

Whereas in the past the primary emphasis was on offering classical investment advice, i.e. expertise on specific asset classes or individual stocks and bonds, increasing focus is today being placed on regulatory issues. Hence the advisory process has been subjected to the tug of war between an array of new regulatory decrees and the individual investment and wealth objectives of clients. Client advisors are therefore faced with new methodological and professional challenges that make ongoing higher education a necessity.

VP Bank has risen to these challenges. In addition to comprehensive training sessions for client advisors in the important areas of tax and cross-border regulations, the Bank’s clients are also being accompanied more frequently by teams of specialists who can offer the all-encompassing competence of VP Bank.

Clients have a right to be served by an advisor who has a keen understanding of their requirements and a comprehensive grasp of their individual financial circumstances. Given that knowledge, the advisor can devise solutions that are best suited to the short term as well as the longer run. In 2015, VP Bank paid the utmost attention to that right on the part of intermediaries as well as its private clients. In today’s environment, staying focused on specific client groups and markets is of particular importance. For instance, in 2015 a certification process was conducted for client advisors who service the German market. And with VP Bank’s “Key Account Management”, a new, comprehensive advisory approach was introduced for fiduciaries and asset managers. Our clients’ reactions prove that VP Bank is on the right path with all of these measures.

Quality and efficiency in the advisory process

One of VP Bank’s major objectives in 2015 was to achieve a significant increase in efficiency. Various initiatives were launched in this regard:

- Electronic communication: ongoing optimisation of the e-channels as well as e-banking and the mobile banking application;

- Development of needs-oriented advisory packages;

- Establishment of a Business Process Management platform: automation of the client life cycle processes for optimising client-data compilation as well as account administration and balancing, with the goal of affording clients and advisors more time to focus on the essential and less on the formalities.

In addition, a new advisory tool was evaluated in 2015. It is aimed at helping the client advisor, together with the client, to develop and implement the most suitable investment strategy, whilst also ensuring that all regulatory aspects have been taken into account and all requirements concerning the investments are met. The tool can be utilised during visits to the Bank as well as at the client’s preferred meeting location.

Cross-border banking

The legal and reputational risks involved in the cross-border financial services business have increased markedly in the recent past. Foreign supervisory authorities are keeping a keen eye on the legal conformity of foreign banks’ cross-border business activities, which include the acquisition, advising and servicing of clients located abroad.

As VP Bank Group renders cross-border services, the Bank has regulated those activities in a binding “cross-border policy”. This directive serves as an adequate instrument for recognising, managing and controlling the related legal and compliance risks. It also lays down the principles as well as the ways and means by which the cross-border services and products of the Bank are to be offered. For each of its target countries, VP Bank provides its client advisors with country manuals which describe the local behavioural dos and don’ts from a legal standpoint.

Advisory process

The acquisition of clients represents the starting point for the advisory process. Most of VP Bank’s new clients come to the Bank at the recommendation of existing clients. Client care is accomplished via a systematic process that centres on the specific needs of the given client.

1. Understand the client

Right from the very start, VP Bank wants to gain a comprehensive familiarity with its clients. Here, the primary questions are:

- Who is sitting across from me at the table?

- What are the obvious characteristics of that person?

- What were his or her motivators in the past; what are they today?

- What goals do they wish to pursue?

- How can we as a bank support them in achieving those goals?

The quality and quantity of the information requested/received from the client are decisive factors in the subsequent advisory process and crucial to its being conducted in a goal-oriented manner. A prerequisite for successful collaboration with corporate clients or intermediaries is having a solid understanding of their specific business model.

2. Advise the client

In devising the most appropriate investment solutions, alternatives and various scenarios are always borne in mind. The client is not only shown the solutions that are “the closest fit”, but also sensible possibilities in a broader context. VP Bank Group attaches great value to a team approach in the development of solutions. Accordingly, specialists as well as other sources of expertise are included in this process at an early stage and, if need be, are also in direct contact with the client.

3. Implement the client’s wishes

If the client agrees to the presented solution, implementation is the next step. Quality and precise timing are crucial in this regard. The time taken for translating solutions into reality underscores VP Bank’s performance capabilities and devotion to achieving the exceptional. VP Bank considers it extremely important that this implementation is conducted in a timely manner or in keeping with agreed milestones that fulfil the expectations of the client.

4. Accompany the client

The advisory process does not simply end upon realisation of an agreed solution. Client wishes and the client profile change continuously. By periodically comparing the past and present client profile as well as the effects and performance of a previously agreed solution – this through proactive contact with the client – VP Bank generates true added value for its clients.

Investment recommendations

At the outset of 2015, VP Bank’s investment experts reckoned that the rally in the global financial markets would gradually lose steam. In end effect, this actually came to pass: returns on the main asset classes were generally much lower than in the previous years and equity market volatility picked up again.

In that their yields remained essentially unchanged throughout the year, government bonds once again performed better than expected. As to other fixed-income securities, it paid to be cautiously positioned in the corporate bond segment. During the course of the year, high-yield bonds in particular came under pressure, as was the case also with emerging nation bonds denominated in local currency.

Due to the increasing or already high stock valuations, differentiating between the various equity markets proved to be the right approach. By regional comparison, generously valued markets like the USA and Switzerland only managed to record very modest returns for the year, and this mostly due to their dividend payments. The eurozone equity markets performed clearly better. Disappointing, however, were the emerging markets, where unfavourable conditions prevailed in 2015.

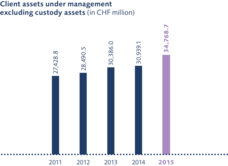

Client assets

As at 31 December 2015, VP Bank held client assets under management totalling CHF 34.8 billion, a 12.4 per cent increase over the previous year. Assets held in custody accounted for an additional CHF 8.2 billion. Total client assets at the end of the year therefore amounted to CHF 43.0 billion (previous year: CHF 38.6 billion). On balance, VP Bank Group recorded a net inflow of CHF 6.0 billion in new client assets (previous year: a net outflow of CHF 0.9 billion).