Employees of VP Bank

In service of the corporate strategy

For a number of years now, the business environment for private banking has posed tremendous challenges for the financial services industry: heightened regulatory requirements for products and services, more intense competition and lower margins, combined with the changed needs of clients.

VP Bank Group faces these challenges by having a correspondingly aligned organisation and appropriately fine-tuned processes. The interplay between the business units and various local offices is a crucial element in rendering the Bank’s wide array of services. But ultimately, it is the Bank’s employees who carry out those functions. With their specialised know-how, commitment and readiness for any necessary adjustments, they are the key to VP Bank Group’s success. And that applies to all of the Bank’s people, across all hierarchical levels and areas of expertise, and regardless of whether or not they have direct client contact.

Especially in the financial services business, the decisive resource for gaining and maintaining the trust of clients is a team of motivated, competent and service-oriented employees who possess keen interpersonal skills. VP Bank Group is mindful of what a positive office environment means to employees, and offers them the chance to take advantage of numerous opportunities. Precisely in trying times when the goal posts are constantly being shifted, VP Bank Group treats its employees with respect and openness in all situations and fosters constructive collaboration.

Managing human capital

The existing Human Resources (HR) management strategy, which is derived from the 2020 company strategy, has been redesigned and thoroughly revamped. The pillars of the HR strategy include support for a service and company culture in connection with performance-based pay, consistent with regulatory provisions and employee and management trends. Spheres of activity were defined and will be gradually implemented in line with the Bank’s overall goals in the years ahead.

The paramount objective of the HR strategy, i.e. handling the daily personnel-related matters, has never changed: at all locations, the proper people must be in place at the proper time and in sufficient numbers, and in particular have the requisite professional know-how and the relevant skills. Provided they are already identifiable, future developments are also taken into account and proactively included in the activities.

Defined processes for coordinated collaboration

Many people are involved in the management of human resources. They include in particular the line supervisors and local HR heads, the central HR employees, as well as local management and that of the Group. It is therefore necessary to appropriately define and coordinate the interactions through the allocation of tasks, competencies and responsibilities, as well as to establish the procedures for the most important situations (such as recruitment, departure, salary determination, promotion, etc.). Particularly in terms of employee development – a core element of personnel work – the proper interaction between the responsible supervisors, the employees themselves and the HR specialists is decisive in achieving the desired results.

The defined HR process and its various sub-processes is an indispensable aid in this shared personnel work. Any necessary adjustments come to light from its repeated application. Identified possibilities for optimisation are promptly translated into reality, thereby keeping the various processes up to date.

In terms of corporate management, the MbO (Management by Objectives) process is accorded a central role. At Group level, the first step is to break down the agreed goals of VP Bank Group and assign the related responsibilities to the Group companies and business units. At the individual level, the corresponding goals and primary tasks are subsequently agreed for each employee. Through this process, the employees’ activities are systematically steered in the desired direction and the ultimate achievement of the Bank’s goals is coordinated with the individual goals.

At the end of the given period, the supervisor assesses the accomplishments of the employee in order to establish the basis for a performance-oriented remuneration component. The supervisor takes into account the extent to which the employees have achieved their goals and fulfilled their primary tasks and in particular their compliance with regulatory provisions, internal rules and client-specific instructions. Through Management by Objectives, supervisors place trust in their employees, afford them leeway for shaping their own approach to work, and identify the necessary personal development measures.

Human Resources central staff office

In collaboration with the supervisors, the management of each Group company bear responsibility for the actual deployment of their employees and for making the necessary resources available. In their staff function, local employees of the personnel department provide assistance through their relevant know-how as well as by performing specific administrative tasks. The line supervisor has decision-making authority in addressing concrete issues.

From the Liechtenstein head office, the Group Human Resources unit offers its entire spectrum of services. This encompasses all operative HR activities, including the rendering of advice and support to supervisors and employees. In Liechtenstein, the operation of the central HR system as well as management of the Group-wide structural organisation is handled for the entire VP Bank Group. This internal specialised know-how is at the disposal of management for deciding on conceptual matters, and thereby flows into the further development of Group-wide human resources management.

At the branch offices and subsidiary companies, local management sees to the necessary HR administrative tasks or retains external partners to do so. Since the beginning of 2014, the central HR unit at the head office in Liechtenstein accompanies the local HR personnel in administrative and professional matters. The Zurich and Luxembourg offices each have one local HR specialist.

Inclusion of employees

In 1998, the Employee Representative Body (ERB) was established at the Liechtenstein headquarters in response to the newly adopted Workers’ Participation Act. In its current composition, the five members were elected at the end of 2012 to a four-year term of office. Following the merger with Centrum Bank AG, two former Centrum Bank AG employee representatives were added, bringing the total number of members up to seven.

The activities of the ERB are based on the internal workers’ participation ordinance, which was enacted by Group Executive Management. The latter must inform and include the ERB if and when the general terms of employment are to be changed or if a reduction of the workforce is envisaged. However, the decision-making competence for any given matter rests with Group Executive Management.

SAP HCM data platform

Since the introduction of SAP HCM in 2010, VP Bank Group has at its disposal a technological platform for the widest array of HR-related activities. This centralised system represents the common database for all of the Bank’s locations and, in line with the available funding, is continuously expanded in order to accommodate new potential uses and benefits.

The information available in SAP HCM constitutes the backbone of human resources management at VP Bank Group. It reflects the entire Group-wide structural organisation, with budgeted positions and the allocated persons, as well as detailed information on the employees, such as the qualification and authorisation of client advisors to conduct cross-border activities. This central database is not only necessary for the Bank’s HR processes; it also flows into other business processes. For example, on a quarterly basis the future personnel costs are extrapolated for the current year and the year to come.

The central HR unit at the head office is in charge of administering the data. Reports generated by the system are also made available centrally for use by the various locations according to their needs. Line supervisors throughout VP Bank Group have at their disposal a number of “Management Self-Service” functions.

Using this web application, the line supervisor has direct access to the employees’ time management and personal data along with the ability to create reports independently (birthday lists, length of service anniversaries, etc.).

Extensive preparations have also been made to ensure that the launch of an “Employee Self-Service” system goes smoothly. This system, which allows employees to enter their own absences and review their own basic employee data and payroll information, has been operational as from 1 January 2016. It represents another step toward a fully integrated system that reduces manual labour and cuts down on paper consumption. Further automation of support processes is planned.

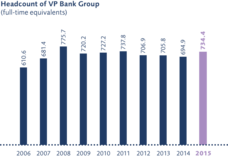

Headcount

Following the integration of Centrum Bank, the number of VP Bank Group employees rose to 777 in January 2015.

The continued implementation of the initiative begun in 2014 to transfer functions from the country organisations to the head office as well as the consolidation of the client service units led to a significant reduction in headcount at the Zurich site, where the number of employees contracted by 12 (12.7 full-time-equivalent) to 62.

At VP Bank in Luxembourg, the headcount also contracted by six employees (6.6 full-time-equivalents) to 99. Thanks to growth in Asia, the number of employees at the Singapore subsidiary increased by five from 25 to 30, while the respective headcounts of the other sites remained unchanged from the previous year.

The number of client advisors increased. VP Bank recruited 18 new client advisors, bringing the total to 151 qualified client advisors (2014: 133). They made up 19 per cent of the Group’s overall headcount, up from 18 per cent the previous year. In Liechtenstein, the number of client advisors increased by 12 to 84, while Switzerland and Luxembourg each added two new client advisors, bringing the respective totals up to 23 and 22.

At 31 December 2015, VP Bank Group had a total of 798 employees, 43 more than at the start of the year.

At end-2015, the average length of service in the VP Bank Group increased further from 9.8 to 9.94 years. At VP Bank, Vaduz, the corresponding figure contracted slightly from 11.4 to 11.37 years.

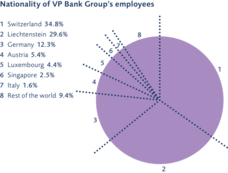

Swiss nationals accounted for 34.8 per cent of all employees and remained the largest country representation (2014: 35 per cent). The relative number of Liechtenstein nationals increased slightly from 29 per cent to 29.6 per cent. German nationals remained the third-largest country representation at 12.3 per cent (2014: 12 per cent).

New hires and departures

2015 was a year of special challenges and marked by merger activity at the head office in Liechtenstein. It was essential to notify as many employees as possible about their job security in a timely manner. Given some overlap in certain functions at VP Bank and Centrum Bank, a process was established to organise the appointments in as fair and transparent a way as possible. To that end, Nomination Committees were created that included representatives from management and Human Resources. Thanks to intensive communications and the proactive and flexible conduct of employees, managers and Human Resources staff, the number of job reductions resulting from the merger was trimmed from the initial December 2014 estimate of between 30 and 40 to only 16. The downsizing affected both Centrum Bank and VP Bank employees.

A generous severance package was negotiated for the affected employees. In particular, this package included an extended notice period based on age and length of service. A so-called new placement advisory service was also made available, where specialised firms provide close support to employees affected by the job cuts and use various means to help them prepare for the job market and future employment. Alternatively, the company provided a contribution to an employability measure such as continuing education. The redundancy programme runs through end-December 2016.

On 15 January 2015 the Swiss National Bank discontinued the minimum exchange rate of CHF 1.20 per euro. Given the challenging environment that followed as well as the merger with Centrum Bank, a Group-wide hiring freeze was implemented for outside personnel at end-January 2015. In the spring, this freeze was gradually lifted and external recruitment was again allowed in special situations. This measure helped VP Bank in its efforts to bring certain former Centrum Bank employees back to positions with VP Bank. Meanwhile, over the summer VP Bank was able to offer a fixed position to all trainees who wanted to remain with the Bank.

Attracting professionally competent individuals with good interpersonal skills who fit into the VP Bank Group family is one of the main tasks involved in HR work. The starting point in the recruitment process is the determination of the need for skills that are intended to enhance a given team. This process, which has been applied for many years now, takes into account not only the professional capabilities of candidates but also their personality, the latter by means of psychological tests.

Measures have been taken to make administrative processes more modern and efficient, so that during the course of 2016 the recruiting process will be standardised and electronically processed, with system-based online job applications also possible.

Major personnel changes also occurred at sites outside Liechtenstein. The streamlining measures were most noteworthy at the Luxembourg and Zurich sites, as some of their functions were transferred to the head office in order to allow them to focus primarily on front office and client activities. In Singapore, VP Bank continues to grow. Competition for good client advisors is intense, but VP Bank was nevertheless able to increase its staffing with the addition of 18 advisors, bringing the total to 151.

In 2015 a total of 140 employees left VP Bank Group (2014: 105), resulting in an employee turnover rate of 16.6 per cent. This figure was expected given the context of the ongoing restructuring and integration of Centrum Bank.

Employee retention and remuneration

As has been recognised for years, work that is perceived to be meaningful and satisfying, as well as the work environment itself, are enormously important in making employees feel comfortable. Many factors can have a negative effect on the work environment: internal influences or external influences due to economic conditions, not to mention events in one’s personal life or family surroundings.

In order to measure employee satisfaction, an anonymous, Group-wide employee survey was implemented in autumn 2015 that had an 88 per cent participation rate. In 2016, working areas will be defined for all management levels, with measures identified on that basis in order to lay the foundation for positive changes.

VP Bank Group is fully aware that it must view its employees within the context of their personal situation in life and differing needs. The members of the Bank’s HR departments are pleased to be at the disposal of all staff and supervisors in order to be of assistance in clarifying any personal issues that may arise. In addition to individual discussions with the affected persons, searching for possible solutions and accompanying those individuals in crisis situations, team analyses and coaching are also some of the tools applied in addressing the issue. Status assessments and career development counselling can also be offered. A broad spectrum of specialised know-how is available internally and, if need be, it can be supplemented by drawing on the skills of external partners.

Remuneration is of course also an essential element when it comes to the satisfaction of employees and their loyalty to the company. VP Bank Group subscribes to the principle of paying fair, competitive compensation. The fixed salary is reflective of the given function and the related requirements, whilst any variable remuneration components are based on the success of the company and individual performance of the employee.

As part of the Bank’s corporate social responsibility, a Volunteering Day was introduced. Each year, employees can spend one day doing charitable volunteer work for a non-profit organisation, which the Bank counts as a normal paid work day. There are no restrictions on the type of work as long as it involves social services, training programmes or ecological/environmental matters.

Employee career development

The financial industry finds itself in a period of change and new challenges. The key for VP Bank is to manage growing complexity and current trends through innovation and entrepreneurial initiative in order to provide clients with the best possible advice. Client advisory is therefore the most important aspect of employee development, since it deals with the broadest range of demands and expectations and constitutes the closest link between the service and the client. As regards employee development measures, the issue is always what type of experience, attributes and skills are needed by employees, regardless of the target group (e.g. client advisors), for them to perform their current or future roles or functions successfully. Development steps can be determined by matching up existing abilities with needed requirements.

In 2015, VP Bank made substantial, targeted investments to develop the know-how of its client advisors. Training was provided in-house with content specific to VP Bank’s business lines and in-house technical areas, supplemented by individual, external development measures.

VP Bank’s training sessions during the year focused mainly on a wide range of technical subjects in the product area as well as compliance and tax law matters. The objective of the training is for clients to be advised in a more targeted and competent manner while improving the quality of the advice through greater depth of knowledge. As part of an even more well-grounded market development initiative, selected client advisors completed a multi-step certification process for the German market. In doing so, they were able to demonstrate their wide-ranging knowledge through real-time discussions with clients.

In order to facilitate access to educational content at all sites regardless of time and location, VP Bank uses efficient e-Learning to convey basic knowledge. For more in-depth and interconnected knowledge, the Bank uses classroom training and various information sessions. The Bank’s own proprietary training platform has more than 100 different learning modules and course offerings in multiple languages. In some cases they constitute mandatory training for all employees through e-Testing. Training is available at all sites in multiple languages.

Managers play an integral role in employee development. In 2015, a majority of the managers at all sites received cultural and leadership development training.

As part of the merger between VP Bank and Centrum Bank, wide-ranging training was offered in the systems, IT and technical areas. This training was enhanced through team-building and cultural sensitivity measures in order to promote learning from one another and to ensure a smooth transition to the new work environment.

At the Liechtenstein site, 38 employees (2014: 28) successfully completed a multi-semester, diploma-based work study programme, while 58 others (2014: 21) were still participating in continuing education at end-2015.

At 31 December 2015, VP Bank had 20 young apprentices (2014: 19) in sales and another four in computer science. During the year, 10 apprentices successfully completed their final exams (2014: eight) and eight of the 10 were offered positions.

VP Bank offers two development models for post-secondary students. The support model offers them the possibility of 50 per cent employment at VP Bank while they complete their studies. VP Bank also offers a career entry track for talented students once they have completed their studies. The Career Start Program is an 18-to-24-month programme that generally involves participating in a wide range of technical areas and functions. At 31 December 2015, three people were participating in these programmes.

Further information is available in the section “The social engagement of VP Bank” under “Responsibility as an employer”.

Employee statistics of VP Bank Group | |||

as of 31.12.2015 | Men | Women | Total |

Number of employees | 476 | 322 | 798 |

Quota in per cent | 59.6 | 40.4 | 100 |

Average age | 42.6 | 41.1 | 42.0 |

Average years of service | 9.8 | 10.1 | 9.9 |

|

|

|

|

as of 31.12.2014 | Men | Women | Total |

Number of employees | 444 | 311 | 755 |

Quota in per cent | 58.8 | 41.2 | 100 |

Average age | 42.1 | 40.3 | 41.3 |

Average years of service | 9.8 | 9.7 | 9.8 |

Headcount per company |

|

| ||||

as of 31.12. | 2015 | 2014 | Variance with previous year | |||

| Employees | Full-time equivalents | Employees | Full-time equivalents | Employees | Full-time equivalents |

VP Bank Ltd, Vaduz | 524 | 473.0 | 472 | 424.9 | 52 | 48.1 |

VP Bank (Switzerland) Ltd | 62 | 57.9 | 74 | 70.6 | –12 | –12.7 |

VP Bank (Luxembourg) SA | 99 | 93.5 | 105 | 100.1 | –6 | –6.6 |

VP Fund Solutions (Luxembourg) SA | 31 | 29.0 | 31 | 28.2 | 0 | 0.8 |

VP Bank (BVI) Ltd | 16 | 16.0 | 17 | 16.9 | –1 | –0.9 |

VP Wealth Management (Hong Kong) Ltd | 7 | 7.0 | 6 | 6.0 | 1 | 1.0 |

VP Bank (Singapore) Ltd | 30 | 30.0 | 25 | 25.0 | 5 | 5.0 |

VP Fund Solutions (Liechtenstein) AG | 29 | 28.0 | 25 | 23.2 | 4 | 4.8 |

Total | 798 | 734.4 | 755 | 694.9 | 43 | 39.5 |