Strategic orientation of VP Bank

Proven business model

The business model of VP Bank is based on two strategic pillars: private banking and the intermediaries business. The home market activities in Liechtenstein are supplemented by retail banking and the commercial business. Supplementing these core capabilities is VP Bank Group’s international fund competency centre.

VP Bank considers it a matter of course and a central task to fulfil all regulatory and cross-border requirements as well as to offer a comprehensive range of services that correspond to the business model of VP Bank Group.

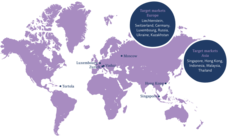

From the various locations of VP Bank Group – namely Vaduz, Zurich, Luxembourg, Tortola, Singapore, Hong Kong and Moscow – clearly defined target markets are actively cultivated. The local offices bear responsibility for developing their own markets and receive coordinative assistance from the Group. The defined target markets for Europe comprise Liechtenstein, Switzerland, Germany, Luxembourg, Russia, Ukraine and Kazakhstan; in Asia, the Group’s focus is on Singapore, Hong Kong, Indonesia, Malaysia and Thailand.

In connection with its annual strategy review, the Board of Directors and Group Executive Management in 2015 conducted an in-depth assessment of the status quo throughout VP Bank Group and from the findings derived the “Strategy 2020”. The primary strategic goal of VP Bank is to grow both in terms of profitability and quality through its activities as a Group in the defined target markets and thereby preserve its independence over the long term.

The key aspects of the strategy are threefold: growth, focus and culture.

Profitable growth

VP Bank Group plans to achieve both organic growth and growth through acquisitions. In achieving the goal of profitable growth, VP Bank’s international branches and the VP Fund Solutions competence centre play a crucial role. Leveraging the benefits of targeted acquisitions is also an important element of this quest for growth.

Through its merger with Liechtenstein-based Centrum Bank in 2015, VP Bank proactively took advantage of an appealing market opportunity to gain an even stronger position in the Liechtenstein financial centre and simultaneously leverage the enormous capacity of its own booking platform. Not to mention that yet another reliable, long-term-oriented Liechtenstein family became an anchor shareholder of VP Bank as part of the deal.

Also in future VP Bank will be keeping an eye out for suitable acquisition opportunities in its target market of Liechtenstein, Switzerland and Luxembourg, whereas any such candidate must fit in with the strategy and culture of VP Bank Group. The shares acquired within the framework of the two repurchase programmes conducted in 2015 are primarily viewed as “funding in kind” for future acquisitions.

For VP Bank, organic growth means winning new clients in its target markets and driving the qualitative growth of its client assets under management. To this end, the markets, client segments, as well as products and services are being developed further and continuously subjected to close analysis at all of the Bank’s locations.

VP Bank anticipates additional growth impulses from its internationalisation efforts. Here, the proportion of revenues attributable to the foreign target markets should increase to 50 per cent of the total over the medium term. Further measures in this regard include the resolute strengthening of the Bank’s position in the especially important area of business dealings with financial intermediaries as well as the further expansion of its investment fund business.

In all of these activities, a prudent approach to dealing with risk is a core principle of VP Bank. The Bank’s internal control system (ICS) is being constantly expanded and helps to manage operational risks actively and efficiently. Further information in this regard can be found in the “Risk management of VP Bank Group” section of this annual report.

Resolute focus

At VP Bank, the term “focus” relates to the reduction of complexities and the costs of internal processes. For years, the financial industry has been faced with the problem of higher cost structures and narrower margins. The increasing regulatory requirements bring about added costs. For those reasons, keen cost consciousness prevails at VP Bank.

Localising the potential for cost savings was a major, and successful, activity this past year. Measures derived from various projects were largely implemented and the findings incorporated into a disciplined, ongoing cost management process, which includes the identification and exploitation of savings potential within the Group as well as the optimisation of the Bank’s palette of products and services.

In recent years, the Luxembourg location has been a target of measures aimed at increased efficiency. In October 2014, VP Bank initiated a project which on one hand brought the local business processes in line with the Group standards and, on the other, contributed to the avoidance of location-transcending service redundancies. In this connection, it was necessary to introduce in Luxembourg the Group standards under observance of the domestic regulatory requirements. VP Bank successfully concluded the project in late 2015 and now a solid, systematised fundament of processes and procedures that take into account the country-specific rules and regulations is in place.

Other aspects of our “focus” in 2015 were to be seen in the further optimisation of the Bank’s business segments and products, a revised definition of the target markets, determined efforts in the area of digitisation (as explained below in greater detail) as well as the fine-tuning of VP Bank’s capital adequacy.

Personification of the culture

The third thrust of Strategy 2020 relates to the culture at VP Bank, in particular two main areas: The first deals with measures for reinforcing the selling and performance culture throughout the Group. Here, the goal is to further enhance the advisory skills of front-office staff. They receive support in this effort through consulting tools as well as targeted training courses.

In terms of corporate culture, the emphasis is on promoting team thinking, this with the objective of increasing the transparency of the organisation and its structures and, on that basis, achieving more dynamic processes as well as a heightened “winner” mentality. By emphasising the strengths of VP Bank, this kind of culture establishes a clearly distinguished profile both internally and externally and is a potent force in the competitive arena. A comprehensive seminar addressing the theme “A culture of leadership” was conducted in the autumn of 2015 and a second round is being planned for 2016.

Owing to these extensive changes, the question arises at VP Bank as to which culture is best suited to today’s new challenges. Group Executive Management has drawn up guidelines under which each employee is encouraged to assume more self-responsibility. To foster a results- and performance-oriented culture, various methodological principles and work practices have been defined in keeping with the spirit of “Culture and Leadership”. Special emphasis was placed in 2015 on the organisational and cultural transition at the Luxembourg location as well as on the integration of Centrum Bank.

New medium-term goals

Based on Strategy 2020, VP Bank’s medium-term goals have been examined and adapted. Until mid-2015, the declared target for the medium term were a tier 1 ratio of at least 16 per cent, a cost/income ratio of 65 per cent, and an average annual growth rate of 5 per cent in net new money. Closer scrutiny of these goals revealed the necessity for adjustments.

At the end of 2014, the legally prescribed minimum core capital ratio was 8 per cent; VP Bank’s tier 1 ratio was more than twice that amount. Given that VP Bank in Liechtenstein is now deemed to be “system relevant", the corresponding equity capital requirement under Basel III (CRD IV) increased as of February 2015 to 13 per cent. Hence a medium-term goal of at least 16 per cent no longer represents an added value for investors and clients; by the same token, any increase of the currently target level would severely limit the financial leeway – for example, to conduct acquisitions.

For those reasons, the Board of Directors has defined the following new medium-term targets for the end of 2020:

- CHF 50 billion in client assets under management;

- CHF 80 million in Group net income; and

- a cost/income ratio of less than 70 per cent.

New organisational structure

In 2015, VP Bank Group adapted its organisational and management structure and refocused the tasks of Group Executive Management. This evolutionary step was taken in reflection of the Bank’s strategy and its medium-term goals for 2020. At the same time, it takes into account the new structural and organisational requirements arising from the merger with Centrum Bank as well as the ever-changing economic and regulatory circumstances. For instance, the rules of Basel III prescribe that a risk management function be in place and totally separate from the operative business units in order to exclude the possibility of conflicts of interest in the course of daily business. The reasonable reconfiguration defined by the Board of Directors is taking place simultaneously with the redoubled focus on clearly delineated client segments and selling channels. This not only underpins the Group’s efforts to grow qualitatively and profitably in its target markets, but also generates added value for clients.

Effective as of 1 January 2016, the organisational unit “Chief Operating Officer” has been established to supplement the previously existing “Chief Executive Officer”, “Client Business” and “Chief Financial Officer” organisational units.

As the newest member of what is now a four-man Group Executive Management team, the Chief Operating Officer bears responsibility for the Group Information Technology, Group Treasury & Execution, Group Credit and Group Operations divisions. This focused allocation of tasks is consistent with a strengthening of the relevant support functions and the resolute optimisation of processes. It also reflects the relentless move towards digitalisation as well as the increasing significance of IT-based processes and solutions – both in the intermediaries business and the private banking area.

Going forward, the Chief Financial Officer will devote his efforts to implementing and steering the Group-wide financing strategy and future planning processes of the Bank. In so doing, he will still be in charge of the Group Finance and Group Risk offices, as well as assume the function of Chief Risk Officer for the Group in keeping with the requirements of Basel III.

Group Executive Management can rely on the assistance of a broadly based second-level management corps of 17 individuals.

The client groups at VP Bank

VP Bank focuses on three main client groups and has developed specific service models for each of those groups.

In the private banking area, the offer for direct clients is being successively broadened with an optimised range of products and services as well as innovative forms of communication; this, of course, in combination with VP Bank’s decades of investment competence.

The intermediaries business is steadily gaining in importance, due on one hand to the merger with Centrum Bank but also to increasing demand at the Bank’s international locations. VP Bank is expanding its partnerships with this target group and making new models available for their use – for example, expanded platforms that provide banking services, training courses, research, cross-border and compliance know-how, as well as investment controlling, all of which are already available inhouse and are now being offered to a broader circle of intermediaries. Efficient service models for fiduciaries and external asset managers, the personal nurturing of relationships and the establishment of strategic partnerships are evidence of VP Bank’s intensified client orientation, optimal deployment of resources and heightened service quality. Through “Key Account Management”, a new and more comprehensive advisory approach has been introduced and offers mid- and large-sized fiduciary clients as well as asset managers VP Bank’s vast range of services in a tailored, suitable manner. In connection with the expansion of these activities, the Intermediaries organisational unit was restructured as of 1 November 2015 and simultaneously the function of unit head was broadened to include specialist responsibility for VP Bank Group’s entire intermediaries business.

VP Bank is also intensifying its personal relationships with external asset managers and positioning itself more distinctly as a top provider of banking services.

VP Fund Solutions

VP Bank Group has outstanding competence in the investment fund business, which encompasses the entire spectrum of relevant services – from the planning to the founding and ultimately to the operative administration of funds – and has been successfully pursued for decades out of the Bank’s Liechtenstein and Luxembourg locations.

The fund business represents an especially attractive growth segment for VP Bank Group. Upon the arrival of a new general manager as of 1 January 2015, responsibility for the entire Luxembourg and Liechtenstein fund business was centrally consolidated. Group-wide leadership of this strategically important business is now handled out of Luxembourg. Since August 2015, the two fund companies of VP Bank in Luxembourg and Liechtenstein do business under the unified name of “VP Fund Solutions”.

Also in the years ahead, VP Bank’s fund competence will grow in importance and be successively broadened. It represents an excellent supplement to the two main pillars of VP Bank’s commercial activities, i.e. private banking and the intermediaries business. Further information in this regard can be found in the section "VP Bank's fund business".

Efficiency and digitalisation

The intentional concentration of key functions and processes in the newly created “Chief Operating Officer” organisational unit makes it possible to reduce superfluous complexities and costs.

In connection with the digitalisation of processes, data and communication channels, numerous measures are being planned or have already been implemented. At the forefront are standardised solutions that can be deployed on a Group-wide scale, and this always with a sharp eye on client needs.

VP Bank’s digitalisation strategy centres on the following major objectives:

- modernising the communication channels to clients;

- expanding the online range of offerings;

- the Group-wide harmonisation of business processes;

- the harmonisation of IT-related services; and

- a reduction of complexities in the process and system environment.

The following examples describe how these ambitions are being realised.

Within the framework of the “POOLIT” project, existing IT infrastructures and systems are being adapted and expanded. The project should enable the centralised rendering of IT services and broaden Group-wide communication links. The goal here is to simplify the compilation of data and optimise the related operating costs.

As of mid-2016, a new investment advisory software application is to be deployed internally. This tool enables the client advisor to render professional, individualised and risk-optimised investment advice based on automated analytical processes, even as it lowers the costs and heightens the quality of that advice.

The centralisation of routine tasks and the automation of certain procedures lead to enhanced quality and facilitate the precise analysis of all of the company’s processes. For that reason, VP Bank is building a Business Process Management (BPM) platform with which processes can be conducted fully by electronic means. The BPM platform is a strategic tool for simplifying these Group-wide processes and reducing the manual work. Processes that are highly standardised and/or require considerable automation are replicated on the BPM platform. The platform is also intended to become a tool for use by client advisors as they attend to the many tasks involved in the “client life cycle”. The software solution utilised is seamlessly integratable into the existing Avaloq core banking application. It forms the basis for savings and makes it possible for the advisors to conduct uniform processes for each client. This way, best practices can be applied comprehensively to the benefit of the entire VP Bank Group. Thanks to its automated business processes, VP Bank can enhance its efficiency throughout the client life cycle, whilst reliably fulfilling the applicable compliance requirements and achieving the complete digitalisation of client records. Clients benefit from the shorter throughput times afforded by these automated processes. In 2015, the account-opening procedure for natural persons became the first in a wide array of processes to be digitalised.

Plans are also for the implementation of a digital invoice management routine aimed at minimising the manual work involved in dealing with invoices from suppliers – this by means of scanning, archiving and optical character recognition of the data automatically extracted from those invoices.

Thriftiness is also being pursued in a targeted manner at the top management level. For example, the “Online Boardroom” has been in use at VP Bank since 2014. This tool adheres to the principle that confidential documents no longer need to be forwarded physically via normal post or electronically via e-mail, but rather be made accessible securely at a central location for all authorised parties. The corporate bodies of VP Bank Group (Board of Directors, Group Executive Management and various committees) have the ability to inspect all relevant documentation by means of a tablet, regardless of where or when those individuals might require that information. This way, meetings can be held in a “paperless environment” and the participants are confident that they always have at their disposal the latest version of a given document. This document management system also ensures that the internal requirements for document administration and compliance are fulfilled.

Further projects relate to new digital tools for use in the areas of payment transactions, securities trading, client contact and the administration of business forms, as well as to the further development of the already proven e-banking and e-banking mobile systems. Also, in a cooperative effort by select client advisors in Liechtenstein, a pilot project has been launched with the primary aim of using tablets as a way to reduce the number of paper printouts during advisory discussions with clients.

This broad-based digitalisation strategy is making a significant contribution not only towards the maximisation of client satisfaction, but also the enhancement of VP Bank’s profitability.

Partnerships

Via partnerships, VP Bank also strives to exploit intercompany synergies. Especially in the Liechtenstein financial centre, cooperative ventures afford a way of countering increasing costs. They allow for the establishment of alliance-based business models. To that end, VP Bank maintains a permanent policy of best-practice sharing with other banks in order to jointly utilise and optimise available resources. In the age of globalisation, a reciprocal transfer of know-how is advantageous for all parties involved.

Strategic partnerships are therefore an important element of VP Bank Group’s business model. VP Bank cooperates with Liechtensteinische Landesbank (LLB) in the area of printing and shipment as well as via a joint procurement company. VP Bank also leases one floor of the LLB data processing centre. The building was conceived and constructed specifically as an energy-efficient data processing centre. In this collaboration, the latest IT solutions and efficient data management are the main motivation for both partners. In the years ahead, VP Bank will continue to examine the feasibility of partnerships and joint projects.

Competent advisors and teams

The private banking industry is still in a state of flux. The rendering of financial advice is different today than it was just several years ago. Clients are better informed, more mobile and more demanding. Additional challenges are posed by ever-stricter regulations and the increasing call for transparency. And due to those client demands, the requirements profile for client advisors has also changed. For excellent, comprehensive client care, a heightened degree of competence is required. Asset management expertise must be combined with insight into cross-border tax law and international finance.

In this environment, VP Bank is in the process of expanding its client base further. The tax transparency and conformity issue is progressively taking centre stage. In order to advise clients even more competently, the Bank is redoubling its efforts in the area of professional training.

In 2015, VP Bank introduced a certification course for client advisors who service the German market. This course, in which a total of 54 client advisors participated, was conducted in collaboration with an external partner and included oral as well as written examinations. With that, VP Bank has laid an additional cornerstone for a location- and division-transcending approach to cultivating its target market in Germany. Thanks to this increased wealth of know-how, the competitiveness of VP Bank and the quality of the advice it provides has been improved significantly. The certifications of personnel will continue in 2016.

Advisory excellence

Outstanding advisory services and tailored solutions are of tremendous importance to the marketing effort. Therefore, issues relating to increased efficiency and quality, resources and processes, first-rate services and products, as well as the qualifications of personnel are of central importance. The successful outcome of the quality-enhancement projects conducted in recent years was evidenced in the Fuchsbriefe Report 2015. This Germany-based private banking assessment organisation once again scrutinised the quality of advice provided in the areas of private banking and private wealth management. Four criteria were evaluated: the advisory discussion, the written wealth investment strategy, the quality of the ultimate portfolio and the transparency of the institution. In a comparison with all other tested providers, VP Bank was rated “commendable” and in the latest Fuchsbriefe ranking holds 20th place out of the 89 examined asset managers from Germany, Austria, Switzerland, Liechtenstein and Luxembourg.

Moreover, in November 2015 the “Elite Report” and the Munich-based “Handelsblatt” newspaper jointly awarded citations for the best asset managers in the German-speaking region. A total of 45 out of the 362 examined asset managers were recognised, and VP Bank made its way into the ranks of the best. Just 12 per cent of the participating firms are deemed commendable by the Elite Report. VP Bank is one of them – and this with the distinction of “cum laude”.

Dedicated employees

In the financial industry, motivated and service-oriented employees are the key to success. Again in 2015, VP Bank launched numerous initiatives aimed at furthering its employees and fostering a positive work environment. The integration of Centrum Bank into VP Bank presented many staff members with challenging tasks that were all successfully accomplished in 2015.

With “myContribution”, VP Bank completely revamped its approach to idea management. This in-house suggestion box has the objective of constantly improving the processes and hence the competitiveness of VP Bank on the basis of ideas submitted by employees. The successfully implemented ideas are rewarded. The spotlight is on people who think, create and venture together in the best interests of the company, because new ideas help VP Bank to advance. In 2015, a total of 53 ideas were submitted compared to only five in 2014.

Last autumn, VP Bank held the internal competition “move – every step counts”. The idea was to journey together, symbolically of course, around the world of VP Bank. The winner was the person who took the most steps, and to that purpose each participant received a cost-free pedometer. This campaign to foster at-work health was a tremendous success. Within the space of 51 days, 249 employees put 60 million paces behind them – the equivalent of 31,965 miles. As a result, the goal of “virtually” visiting all of VP Bank’s global offices was achieved.

After a longer pause, an employee survey was conducted again in late 2015. The participation rate of 88 per cent attests to the great interest VP Bank employees have in their company. The detailed findings will be presented in the spring of 2016.

A comprehensive overview of all employee-related measures can be found in the section “Employees of VP Bank”.

Further development of products and services

VP Bank’s traditional range of offers is regularly examined for its currentness and is supplemented whenever necessary with need-oriented services and products.

In 2015, three new banking service packages were introduced at VP Bank. They offer a wide range of solutions and enhance the comprehensibility and transparency of the Bank’s products and services. These new packages are in keeping with the corporate strategy and have been tailored to reflect the constantly changing needs of clients.

The product offer for existing clients is being successively broadened to include modern forms of communication. For years, VP Bank has made available its highly refined e-banking platform, and already in 2013 a new version of “e-banking mobile” was introduced. The latest release turns a smartphone into a mobile bank and enables the environmentally friendly transmission and receipt of “e-Post”. Clients have the possibility to conduct smartphone-based queries of their securities and safekeeping balances, as well as to enter orders for securities trades and payment transactions. In addition, payment slips can be scanned in using the smartphone’s inbuilt camera.

In the summer of 2015, e-banking and e-banking mobile were augmented through the integration of the most current market data. And now there is even the possibility to receive automatic notification of payments that have been paid into the account. To that purpose, a secure “push channel” is utilised.

The modern technological features are highly popular: for instance, the use of VP Bank e-banking in 2015 increased over the previous year by another 12 per cent after having recorded an impressive 56 per cent gain in 2014. Today, far more than 70 per cent of all payment orders are entered online.

Outlook

VP Bank has achieved the major objectives it defined for 2015, namely the integration of Centrum Bank into VP Bank, the optimisation of resource allocation and the avoidance redundancies at VP Bank (Luxembourg) SA, as well as the bundling and uniform coordination of VP Bank Group’s investment fund know-how. Now, the task is to build on the results of those processes.

VP Bank continues to foresee a low interest-rate environment and a further increase in rules and regulations applicable to the financial industry. For 2016, the topics of growth, expanding the skillset applied in client advisory activities, as well as intensifying VP Bank’s market cultivation efforts will take centre stage.

VP Bank Group is well equipped to meet the challenges that lie ahead. This is also vouched for by the Bank’s excellent “A–” rating (A–/Negative/A–2) from Standard & Poor’s, which the rating agency reconfirmed in August 2015. VP Bank’s solid equity base enables investments in growth by means of targeted acquisitions.