Consolidated annual report of VP Bank Group

Consolidated results

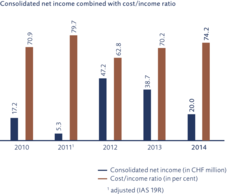

The consolidated financial statements for VP Bank Group from 2014, prepared in accordance with International Financial Reporting Standards (IFRS), disclose a Group net income of CHF 20.0 million. In the prior year, the Group realised a Group net income of CHF 38.7 million.

The continuing decline in Swiss-franc capital-market interest rates gave rise to unrealised revaluation losses on interest rate hedges, thus leading to this decline. If the losses on interest rate hedges are ignored, consolidated net income in 2014 totals CHF 36.0 million (prior year, after adjusting for gains on interest rate hedges: CHF 30.1 million).

VP Bank Group continues to pursue its growth strategy. The acquisition of the private banking activities of HSBC Trinkaus & Burkhardt (International) SA as well as the private-banking-related investment fund business carried out by HSBC Trinkaus Investment Managers SA in Luxembourg were successfully completed in 2014. Adjusted for the effects arising from the interest rate hedges, total operating income and operating revenues could also be increased thanks to this acquisition. Although the process of growth could be further sped up, additional savings could be achieved at the same time thanks to active cost management and costs could be reduced relative to the prior-year level. The merger with Centrum Bank, which was announced on 1 December 2014, has further allowed VP Bank Group to continue its successful strategy of growth by acquisition.

The expectations of economists for 2014 again proved to be too high. During the course of the year, major institutions such as the IMF had to successively reduce their growth forecasts. In the Eurozone, although the debt-plagued countries in the currency area continued on their path of recovery, the German economy developed on an unexpectedly bumpy road – not least because of the sanctions against Russia. When considering the adverse conditions in the neighbouring European currency zone, the economies of Liechtenstein and Switzerland proved to be extremely robust. Inflation rates of the industrial nations receded markedly against the backdrop of massively declining oil prices, primarily in the second half of the year. The central banks of major countries thus needed to maintain their expansive monetary policies. Nevertheless, monetary positioning on both sides of the Atlantic varied considerably. While the US Federal Reserve ended its monthly purchases of securities in October on the back of strong economic growth, the ECB launched into a large-scale programme of government bond purchases in January 2015. These factors also impacted the business activities of VP Bank and are reflected in both revenues and in client-based activities.

The Board of Directors will propose a dividend of CHF 3.00 per bearer share (prior year: CHF 3.50) and CHF 0.30 per registered share (prior year: CHF 0.35) at the annual general meeting to be held on 24 April 2015. The dividend proposal is based upon the dividend policy defined by the Board of Directors. 40 to 60 per cent of the Group net profit generated should be distributed to shareholders so long as the medium-term tier 1 target of 16 per cent is exceeded. The objective is to achieve constant growth in dividends. The dividend proposed by the Board of Directors is based upon the result of CHF 36.0 million after adjusting for the revaluation losses resulting from interest rate hedges.

Medium-term goals

In the medium term, VP Bank Group is striving to achieve the following measures:

- A net new money inflow of an average of 5 per cent per annum

- A cost/income ratio of 65 per cent

- A tier 1 ratio of 16 per cent

In 2014, VP Bank Group recorded a net outflow of client assets of CHF 850 million. In 2013, a net new client money inflow of CHF 965 million had been achieved (including the asset deal with HSBC Trinkaus & Burkhardt (International) SA in Luxembourg).

Despite lower costs, the cost/income ratio increased to 74.2 per cent in 2014 (prior year: 70.2 per cent). The declin- ing total operating income is responsible for this increase, whereby the effect of interest rate hedges (CHF 24.5 million) is not taken into account in this calculation.

In 2014, the tier 1 ratio increased slightly from 20.4 per cent to 20.5 per cent (measurement date: 31 December 2014). In this manner, VP Bank Group possesses a solid capital base when compared with other financial institutions. The medium-term goal of 16 per cent was again far exceeded in 2014.

The regulatory framework Basel III imposes stricter capital-adequacy and liquidity requirements on banking institutions. As VP Bank is classified as a system-relevant bank, the required equity capital in accordance with the aforementioned new capital-adequacy requirements under Basel III (CRD IV) increases to 13 per cent. These changes take effect as of February 2015. Even after the introduction of Basel III, VP Bank Group will continue to have a robust core capital (tier 1 ratio), thus reflecting a high measure of stability and security.

Client assets under management

At the end of 2014, client assets under management of VP Bank Group totalled CHF 30.9 billion. Compared with the prior year’s figure of CHF 30.4 billion, this represents an increase of 1.8 per cent. The performance-related increase in client assets amounted to CHF 1.4 billion, result- ing from the positive development in markets.

In 2014, VP Bank Group recorded a net outflow of client assets of CHF 850 million (prior year: net inflow of client money of CHF 965 million, including the asset deal with HSBC Trinkaus & Burkhardt (International) SA in Luxembourg). As a result of regulatory changes, particularly taxation-related issues, client assets again came under significant pressure. In the custodian bank and investment fund businesses, the loss of a major client was worthy of note. On the other hand, as a result of successful market development activities, VP Bank Group succeeded in counteracting the net outflow of client money in existing businesses. The inflows generated, however, were not able to offset the outflows in client assets under management. With the merger announced with Centrum Bank, VP Bank Group will add client assets of some CHF 7.1 billion in 2015 (position at beginning of 2015).

Custody assets declined by 15.4 per cent to CHF 7.6 billion (prior year: CHF 9.0 billion). As of 31 December 2014, client assets including custody assets totalled CHF 38.6 billion (prior year: CHF 39.4 billion).

Income statement

Total operating income

Year on year, total operating income declined by 7.0 per cent from CHF 239.4 million to CHF 222.7 million. Adjusted for the effect of interest rate hedges (CHF 24.5 million), total operating income increased by 3.4 per cent.

Interest income, after adjusting for the results of interest rate hedging operations, rose by 4.1 per cent from CHF 78.3 million to CHF 81.5 million. As a result of the further decline in interest rate levels, interest income from banking operations fell during the reporting period. At the same time, interest revenues from client-related business grew slightly. Interest expense declined by CHF 1.5 million. Interest income from financial instruments valued at amortised cost rose by CHF 3.1 million to CHF 15.2 million, principally as a result of a higher level of balance-sheet positions. As VP Bank does not apply hedge accounting in accordance with IFRS, the interest income also includes changes in the value of interest rate hedges. In 2014, there resulted unrealised losses of CHF 16.0 million (prior year: revaluation gains of CHF 8.5 million). From an economic point of view, no revaluation differences result from the underlying positions and hedges.

The increased level of client activity fortunately continued in 2014. As a result, income from commission business and services again rose by 3.8 per cent to CHF 118.4 million (prior year: CHF 114.1 million). Net brokerage income grew by 5.3 per cent to CHF 33.4 million (prior year: CHF 31.8 million). The marked increase in investment fund management fees of CHF 6.7 million to CHF 62.8 million, or 12.0 per cent, arose in connection with investment fund business acquired from HSBC Trinkaus Investment Managers SA in Luxembourg. Commission income from other services grew by CHF 3.6 million to CHF 17.7 million. Other commission and service-related expense increased by CHF 7.6 million to CHF 49.7 million. This increase is principally in connection with investment fund management fees which are passed on.

Income from trading activities in 2014 rose by 30.0 per cent from CHF 19.5 million to CHF 25.4 million. Trading on behalf of clients increased by 19.0 per cent to CHF 29.6 million (prior year: CHF 24.9 million). Year on year, securities trading improved by CHF 1.1 million. In 2014, a negative result of CHF 4.2 million (prior year: CHF –5.4 million) arose from hedging operations in respect of financial investments which is recorded under securities trading. These changes in value arising from hedges are offset by revaluation gains/losses in the hedged underlying positions.

Gains from financial investments of CHF 12.5 million (prior year: CHF 16.3 million) were generated in 2014. The major part thereof resulted from revaluation gains on the one hand, and interest income on the other.

Operating expenses

Year on year, operating expenses fell by 1.6 per cent to CHF 165.3 million.

Personnel expenses fell year on year by CHF 3.5 million, or 2.9 per cent, to CHF 118.5 million. This decline is a result of the slightly lower employee headcount. At the end of 2014, VP Bank Group had 695 (prior year: 706) employees, expressed as full-time equivalents.

General and administrative expenses increased by 1.7 per cent from CHF 46.0 million to CHF 46.8 million in 2014. On the one hand, thanks to strict cost discipline, savings in various expense positions could be achieved, but, on the other, professional fees rose by CHF 1.1 million to CHF 9.1 million. The higher level of expense arose in connection with projects relating to achieving growth targets and, in particular, with the announced merger with Centrum Bank AG

Depreciation and amortisation was CHF 2.3 million or 8.6 per cent higher than in the prior year and amounted to CHF 29.3 million, whereby this increase relates principally to the scheduled amortisation of intangible assets acquired within the framework of the asset deal with HSBC Trinkaus & Burkhardt (International) SA.

The charge for valuation allowances, provisions and losses totalled CHF 7.4 million (prior year: CHF 6.4 million). The increase relates, in particular, to the higher valuation allowances for credit risks, whereby the higher charges were recorded both for individual as well as lump-sum valuation allowances. On the other hand, valuation allowances no longer required totalling CHF 8.0 million were released to income (prior year: CHF 4.0 million). This also included the provision raised in the prior year in connection with the US programme from which VP Bank (Switzerland) Ltd withdrew following extensive clarifications.

Group net income

Group net income totalled CHF 20.0 million (prior year: CHF 38.7 million). Group net income per bearer share fell from CHF 6.58 to CHF 3.45 in the 2014 reporting period.

Total comprehensive income

Total comprehensive income encompasses all revenues and expenses recorded in the profit and loss account and under equity. VP Bank Group achieved a total comprehensive income of CHF 0.5 million as opposed to CHF 28.7 million in the prior year. This reduction is principally the result of actuarial adjustments in respect of retirement pension funds, which were recorded directly in equity.

Balance sheet

Total assets remained unchanged at CHF 11.2 billion. On the liabilities side, amounts due to clients were also unchanged at CHF 9.6 billion. On the assets side, cash and cash equivalents again increased markedly to CHF 1.9 billion (31 December 2013: CHF 1.4 billion), which signifies a very comfortable level of liquidity for VP Bank. The increase in cash and cash equivalents was made at the expense of amounts due from banks, which declined by a further CHF 1.2 billion to CHF 3.3 billion. At the same time, financial instruments valued at amortised cost rose by CHF 297.9 million (plus 38.4 per cent) from CHF 776.2 million to CHF 1.1 billion in 2014.

VP Bank is maintaining its focus on qualitative growth in client loans as well as a high level of discipline in credit-granting activities. Since the beginning of 2014, loans to clients have risen by CHF 337.3 million to CHF 4.3 billion as of 31 December 2014. This increase relates in roughly equal measure to mortgage loans and credits with other types of collateral. Mortgage loans recorded an increase of 6.1 per cent to CHF 2.9 billion.

Consolidated shareholders‘ equity of VP Bank Group at the end of 2014 amounted to CHF 868.5 million (end of 2013: CHF 888.7 million). The decrease of CHF 20.3 million is primarily attributable to actuarial adjustments in respect of retirement pension funds. As of 31 December 2014, the tier 1 ratio was 20.5 per cent (prior year: 20.4 per cent).

Outlook

The decision of the SNB in mid-January 2015 to abandon the exchange rate floor of CHF 1.20 per euro will have a lasting impact on the capital market environment. It has not only resulted in shifts on currency markets, but has also seen interest rate levels move lower at their short and long ends. Outside the Swiss currency zone, central banks will also continue to exercise strong influence on markets. Although global monetary policy remains expansive, at a regional level there remain large differences. We consider bonds to be unattractive. Despite higher valuations, equities should profit from the scarcity of investment opportunities.

VP Bank Group expects the uncertainties to persist in the 2015 fiscal year. The abandonment by the SNB in January 2015 of the CHF/EUR exchange rate floor as well as the shift in the three-month LIBOR target range led to major disruptions on markets. This difficult environment poses great challenges to VP Bank Group and impacts the course of business in a significant manner. VP Bank Group is well positioned and counters these demands with concrete measures. Together with its employees and clients, it will continue to pursue the course it has embarked on in a consistent manner towards a successful future.

The process of transformation in the areas of tax transparency as well as the automatic exchange of tax information are developments which will preoccupy VP Bank and the Liechtenstein financial centre in the coming years in no uncertain manner. With the merger of VP Bank and Centrum Bank, VP Bank has shown a firm commitment to the Liechtenstein marketplace. Thanks to its business model with comparable core competencies, target markets and client structures, VP Bank considers Centrum Bank to be an ideal addition for ensuring a successful future for the Group. As a result of the capital increase which is planned to accompany the merger, another reliable and long-term-oriented Liechtenstein family will become an anchor shareholder of VP Bank. In addition, equity will not be significantly impacted as a result of these transactions. The high level of equity resources constitutes a healthy basis for VP Bank Group to be able to assume an active role in the process of bank consolidation