Employees of VP Bank

In service of the corporate strategy

For a number of years now, the business environment for private banking has posed tremendous challenges for the financial services industry: heightened regulatory requirements for products and services, more intense competition and lower margins, combined with the changed needs of clients.

VP Bank Group faces these challenges by having a correspondingly aligned organisation and appropriately fine-tuned processes. The interplay between the business units and various local offices is a crucial element in rendering the Bank’s wide array of services. But ultimately, it is our own employees who carry out these functions. With their specialist expertise, commitment and readiness for any necessary adjustments, they are the key to VP Bank Group’s success. And this applies to all of the Bank’s people, across all hierarchical levels and areas of expertise, regardless of whether or not they have direct client contact.

Especially in the financial services business, the decisive resource for gaining and maintaining the trust of clients is a team of motivated, competent and service-oriented employees who possess excellent interpersonal skills. VP Bank Group is mindful of what a positive office environment means to employees, and offers them the chance to take advantage of numerous opportunities. Precisely in trying times when the goal posts are constantly being shifted, VP Bank Group treats its employees with respect and openness in all situations and fosters constructive collaboration.

Managing human capital

In 2007, a specific Group-wide strategy for managing human resources (HR) was derived from the overall corporate strategy and approved by the Board of Directors. Measures were defined and, to the extent possible, implemented in the ensuing years. The paramount objective of the HR strategy, i.e. handling daily personnel-related matters, has never changed: at all locations, the proper people must be in place at the proper time and in sufficient numbers, and, in particu- lar, must have the requisite professional know-how and the relevant skills. Provided they are already identifiable, future developments are also taken into account and proactively included in the activities.

Through collaboration within VP Bank Group, synergies are exploited. Cooperative relationships with external partners are also called upon in an effort to achieve good results in the HR area.

Following the presentation of a status report in 2014, the Board of Directors confirmed the HR strategy and defined the key areas to be emphasised in future activities. The latter include the fostering of a performance-based corporate culture combined with success-oriented compensation that conforms to regulatory requirements, as well as employee and management development initiatives.

Defined processes for coordinated collaboration

Many people are involved in the management of human resources. They include, in particular, the line supervisors and local HR heads, the central HR employees as well as local management and that of the Group. It is therefore necessary to appropriately define and coordinate the interactions through the allocation of tasks, competencies and responsibilities as well as to establish the procedures for the most important situations (recruitment, departure, salary determination, promotion, etc.). Particularly in terms of employee development – a core element of personnel work – the proper interaction between the responsible supervisors, the employees themselves and the HR specialists is decisive in achieving the desired results.

For many years now, the defined HR process and its various subprocesses have been an indispensable aid in this shared personnel work. Any necessary adjustments come to light from its repeated application. Identified possibilities for optimisation are promptly translated into reality, thereby keeping the various processes up to date.

In terms of corporate management, the Management by Objectives (MbO) process is accorded a central role. At Group level, the first step is to break down the agreed goals of VP Bank Group and assign the related responsibilities to the Group companies and business units. At the individual level, the corresponding goals and primary tasks are subsequently agreed for each employee. Through this process, the employees’ activities are systematically steered in the desired direction and the ultimate achievement of the Bank’s goals is coordinated with the individual goals.

At the end of the given period, the supervisor assesses the accomplishments of the employees in order to establish the basis for a performance-oriented remuneration component. The supervisor takes into account the extent to which the employees have achieved their goals and fulfilled their primary tasks and, in particular, their compliance with regulatory provisions, internal rules and client-specific instructions. Through MbO, supervisors place trust in their employees, afford them leeway for shaping their own approach to work and identify the necessary personal development measures.

Human Resources central staff office

In collaboration with the supervisors, the management team of each Group company bears responsibility for the actual deployment of its employees and for making the necessary resources available. In their staff function, local employees of the HR department provide assistance through their relevant know-how as well as by performing specific administrative tasks. The line supervisor has decision-making authority in addressing specific issues.

From the Liechtenstein Head Office, the Group Human Resources unit offers its entire spectrum of services. This encompasses all operative HR activities, including the rendering of advice and support to supervisors and employees. In Liechtenstein, the operation of the central HR system as well as the management of the Group-wide structural organisation is handled for the entire VP Bank Group. This internal specialist know-how is at the disposal of management for deciding on conceptual matters, and thereby flows into the further development of Group-wide HR management.

At the branch offices and subsidiary companies, local management sees to the necessary HR administrative tasks or calls on external partners to do so. Since the beginning of 2014, the central HR unit at the Head Office in Liechtenstein has accompanied the local HR personnel in administrative and professional matters. The Zurich and Luxembourg offices each have one local HR specialist.

Inclusion of employees

In 1998, the Employee Representative Body (ERB) was established at the Liechtenstein headquarters in response to the newly adopted Workers’ Participation Act. In its current composition, the five members were elected at the end of 2012 for a four-year term of office. The activities of the ERB are based on the internal workers’ participation ordinance, which was enacted by Group Executive Management. The latter must inform and include the ERB if and when the general terms of employment are to be changed or if a reduction of the workforce is envisaged. However, the decision-making competence for any given matter rests with Group Executive Management.

The acquisition of Centrum Bank and its merger with VP Bank was announced in late 2014. Since then, the employee representative bodies of both banks have been actively accompanying the integration process and any related staff reductions.

SAP HCM data platform

Since the introduction of SAP HCM in 2010, VP Bank Group has had at its disposal a technological platform for the widest array of HR-related activities. This centralised system represents the common database for all of the Bank’s locations and, in line with the available funding, is continuously expanded in order to accommodate new potential uses and benefits.

The information available in SAP HCM constitutes the backbone of HR management at VP Bank Group. It reflects the entire Group-wide structural organisation, with budgeted positions and the allocated persons, as well as detailed information on the employees, such as the qualification and authorisation of client advisors to conduct crossborder activities. This central database is not only necessary for the Bank’s HR processes; it also flows into other business processes. For example, the future personnel costs are extrapolated for the current year and the year to come on a quarterly basis.

Since 2014, the central HR unit at the Head Office has been in charge of administering the data. Reports generated by the system are also made available centrally for use by the various locations according to their requirements. Line supervisors throughout VP Bank Group have a number of “manager self-service” functions at their disposal.

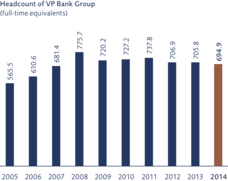

Headcount

In keeping with the strategy of VP Bank, various banking-related (back-office) and management tasks we reallocated to the Head Office in Vaduz during the course of 2014. In parallel, various client advisory units underwent a certain degree of consolidation. At the Zurich location, this led to a considerable 15-person reduction in headcount to a current total of 72 (–13.2 in full-time equivalents). Staffing at VP Bank in Luxembourg was also reduced by 4 persons to a new total of 105 employees (–4.28 in full-time equivalents). Headcount at the other locations remained at prior-year levels.

The number of client advisors fell: the reported total of 133 individuals (previous year: 151) is equivalent to 18 per cent of VP Bank Group’s entire workforce (previous year: 20 per cent). In Liechtenstein, the number of client advisors declined by 6 persons to 72; in Switzerland, by 7 to 21; and in Luxembourg, by 7 to 20.

As at 31 December 2014, VP Bank Group employed 755 individuals, 9 fewer than in the previous year. Adjusted to reflect full-time equivalents, this corresponds to 10.9 fewer than in 2013, namely 694.9 (see table). The proportion of part-time employees (155 individuals; previous year: 152) increased slightly to 21 per cent of the entire workforce.

The average years of service at VP Bank Group rose further from 9.1 to 9.8 years at the end of 2014. This figure for VP Bank in Vaduz increased from 10.9 to 11.4 years.

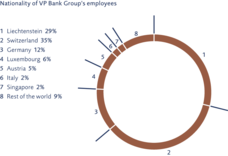

With a 35 per cent share of the total (previous year: 36 per cent), persons with Swiss citizenship constitute VP Bank Group’s largest employee grouping. The proportion attributable to Liechtenstein citizens remained constant at 29 per cent. The third-largest proportion (12 per cent; previous year: 11 per cent) is represented by employees from Germany (see chart).

New hires and departures

Attracting professionally competent individuals with good interpersonal skills who fit into the VP Bank Group family is one of the main tasks involved in HR work. The starting point in the recruitment process is the determination of the need for skills that are intended to enhance a given team. This process, which has been applied for many years now, takes into account not only the professional capabilities of candidates, but also their personality, the latter by means of psychological analysis.

Excluding internships, apprenticeships and temporary employees, 75 individuals joined the company Group-wide in 2014 (previous year: 106). Only a few of these (7 persons) left the company during their first year of service. This particular figure has continually improved over recent years and is indeed also an indicator of the improvements that have been made to the recruitment process. Of the 44 entrants in Liechtenstein and Switzerland, 61 per cent (previous year: 51 per cent) of them have graduated from an institution of higher education (degree or specialist diploma), and most of them also have a number of years of professional experience.

Each time an individual leaves, the function that he or she performed is reassessed. In 2014, it was frequently the case that no replacement was recruited. On the other hand, a new hiring requirement arose due to the shift of certain tasks to the parent company as well as to project-related activities (e.g. the implementation of regulatory provisions). On the whole, the parent company headcount thus remained essentially unchanged, whilst that of the entire Group declined by a total of 9 persons.

Despite all efforts to identify and offer redundant employees a new internal post, dismissals are occasionally necessary. At VP Bank Group, it has been a long-standing practice that employees who lose their job through no fault of their own are provided with additional assistance. Aside from the legally or contractually specified benefits, this support includes, in particular, an extended termination period as well as a contribution towards the person’s future employability (e.g. for “outplacement” accompaniment). At VP Bank Group, 10 individuals received this assistance in 2014.

A total of 105 persons left VP Bank Group in 2014 (previous year: 116). This corresponds to a fluctuation rate of 13.8 per cent, the lowest figure since 2010.

Employee retention and remuneration

As has been recognised for years, work that is perceived to be meaningful and satisfying, as well as the work environment itself, are enormously important in making employees feel comfortable. Many factors can have a negative effect on the work environment: internal influences or external influences due to economic conditions, not to mention events in one’s personal life or family surroundings.

VP Bank Group is fully aware that it must view its employees within the context of their personal situation in life and their differing needs. The members of the Bank’s HR departments are pleased to assist all staff and supervisors in clarifying any personal issues that may arise. In addition to individual discussions with the affected persons, searching for possible solutions and accompanying these individuals in crisis situations, team analyses and coaching are also some of the tools applied in addressing the relevant issue. Status assessments and career development counselling can also be offered. A broad spectrum of specialised know-how is available internally and, if need be, it can be supplemented by drawing on the skills of external partners.

Remuneration is of course also an essential element when it comes to the satisfaction of employees and their loyalty to the company. VP Bank Group subscribes to the principle of paying fair, competitive compensation. The fixed salary is reflective of the given function and the related requirements, whilst any variable remuneration components are based on the success of the company and the individual performance of the employee.

In 2014, the employee stock ownership plan as well as the compensation plan for the first and second management levels were revised. For 2015, further activities aimed at revamping the remuneration system are planned, especially with regard to the client-focused units. Details on the principles of remuneration are provided in the compensation report on page 77.

Employee career development

Coordinated interaction between several hundred people across a number of countries and continents is necessary in order for VP Bank Group to offer clients its defined range of services. The organisational chart shows the companies, units, departments and teams where this interplay takes place. Within the organisation, each employee performs a specific function involving designated tasks, competencies and responsibilities. Individual job requirements can be systematically derived from this matrix: which qualifications must the employee hold, and what degree of professional experience is necessary for the function to be performed competently?

The systematics of the functions, with their respective tasks and requirements, represent a fundamental tool of corporate management and personnel administration. In addition to forming the basis for function-consistent remuneration, they serve as a benchmark for promotions or recruitment as well as an important point of reference for employee development measures. A comparison of employees’ existing skills with the necessary requirements immediately reveals where there is need for development, both at an individual level and cumulatively across entire business units.

Again in 2014, VP Bank Group invested significant sums in banking-specific continuing education measures, for instance in training seminars at the Liechtenstein and Swiss offices aimed at enhancing the quality of advice and improving conversational techniques.

For targeted specialist education, employees throughout the Group have access to a VP Bank e-Learning tool which offers a wide array of courses. In addition to individual, Internet-based study modules, this internal training regime also involves classroom-based courses as well as printed study materials. Tests can be taken individually via the e-Learning applica- tion. At the Bank’s offices in Liechtenstein and Switzerland, approximately 400 individuals have successfully completed training courses on the topics of “Legal, compliance, tax and crossborder”. Assuming a learning/training duration of 4.5 days per participant, this equates to roughly 7.4 man-years of study. Also available are courses on specific banking know-how (e.g. “Vocation check”) with a total of 13 modules or subjects such as “Business continuity management”.

In keeping with the HR strategy, in-house management training was strongly emphasised in 2014. The basis for this is formed by the Leadership Portal on VP Bank Group’s intranet, which provides concise and easy-to-understand information on all HR-relevant topics. Each supervisor is now required to complete the corresponding “Management Check” in the e-Learning application.

At the Liechtenstein location, 28 people (previous year: 22) earned a diploma for completing a multi-semester, extra- occupational training course, and an additional 21 individuals (previous year: 38) were still participating in a similar course at the end of 2014. Of the external costs for education, close to half (46.9 per cent) of the total amount went towards the advancement of banking know-how and other specific professional skills, while 5.5 per cent (previous year: 9.3 per cent) served to improve selling and financial advisory methods. The proportion attributable to the enhancement of management skills increased to 14.3 per cent (previous year: 2.4 per cent).

Taking advantage of opportunities to assume another function, learning new things and keeping pace with today’s interesting challenges: wherever and whenever possible, VP Bank Group offers its employees those opportunities. In 2014, 3 employees (previous year: 7) switched to another Group company. Moreover, at the Head Office alone, 16 persons (previous year: 20) took on a new role and 18 others (previous year: 11) were promoted to a higher-level function.

At the end of 2014, VP Bank Group was training 19 (previous year: 22) young people to become banking professionals and 4 others to become IT specialists. During the course of the year, 8 (previous year: 9) apprentices successfully completed their final exams and all of them were offered a job at VP Bank. The Bank has also developed a support model for university students: they have the possibility during their studies to take a 50 per cent job at VP Bank Group. During the year under review, two employees completed their master’s studies in parallel to their work, one of whom subsequently became a permanent employee of the Bank. A new employee has joined the company and is simultaneously studying for a master’s degree.

If possible, VP Bank Group offers graduates a professional entry point: the “Career Start Programme” is limited to 18 months and usually involves a variety of roles. At the end of 2014, one person was enrolled in this programme at VP Bank.

Employee statistics of VP Bank Group | |||

as of 31/12/2014 | Men | Women | Total |

Number of employees | 444 | 311 | 755 |

Quota in per cent | 58.8 | 41.2 | 100.0 |

Average age | 42.1 | 40.3 | 41.3 |

Average years of service | 9.8 | 9.7 | 9.8 |

|

|

|

|

as of 31/12/2013 | Men | Women | Total |

Number of employees | 460 | 304 | 764 |

Quota in per cent | 60.2 | 39.8 | 100.0 |

Average age | 41.6 | 39.9 | 40.9 |

Average years of service | 9.2 | 8.9 | 9.1 |

Headcount per company |

|

| ||||

as of 31/12 | 2014 | 2013 | Variance with previous year | |||

| Employees | Full-time equivalents | Employees | Full-time equivalents | Employees | Full-time equivalents |

VP Bank Ltd, Vaduz | 472 | 424.9 | 470 | 424.5 | 2 | 0.4 |

VP Bank (Switzerland) Ltd | 72 | 67.6 | 87 | 80.8 | –15 | –13.2 |

VP Bank (Luxembourg) SA | 105 | 100.1 | 109 | 104.4 | –4 | –4.3 |

VPB Finance S.A. | 31 | 28.2 | 27 | 25.6 | 4 | 2.6 |

VP Bank (BVI) Ltd | 17 | 16.9 | 13 | 12.9 | 4 | 4.0 |

VP Wealth Management (Hong Kong) Ltd. | 6 | 6 | 6 | 6 | 0 | 0.0 |

VP Bank (Singapore) Ltd. | 25 | 25 | 25 | 25 | 0 | 0.0 |

Moscow Representative Office | 3 | 3 | 2 | 2 | 1 | 1.0 |

IFOS Internationale Fonds Service AG | 25 | 23.2 | 25 | 24.6 | –1 | –1.4 |

Total | 755 | 694.9 | 764 | 705.8 | –9 | –10.9 |