Compensation report

Regulatory framework

This VP Bank compensation report is based on the implementation of the EU Directive 2010/76/EU, which, amongst other things, regulates the risks associated with compensation policies and practices.

On the one hand, Liechtenstein has implemented this directive in the Law on Banks and Securities Firms, in particular in Art. 7a para. 6 thereof: “Banks and securities firms shall introduce a compensation policy and compensation practices and shall ensure continuously that they are consistent with robust and effective risk management within the spirit of this Article. The government shall regulate the details of the compensation policy and practices in a related ordinance.”

On the other hand, the content of Annex 4.4 of the “Ordinance on Banks and Securities Firms” (FL-BankV) has been supplemented accordingly. This ordinance entered into force on 1 January 2012. VP Bank Group’s remuneration policy corresponds to the size of VP Bank and its business model. This includes the offering of banking services for private clients and financial intermediaries in the disclosed target markets, in Liechtenstein and in the other locations as well as services for investment funds.

Principles of remuneration

Compensation plays a central role in the recruitment and retention of employees. It also has an influence on the future success of the company. VP Bank professes to pursue fair, performance-oriented and balanced practices in terms of compensation, which are in keeping with the long-term interests of shareholders, employees and clients alike.

The long-standing remuneration practices of VP Bank correspond to the business model of VP Bank as an asset manager and private bank. The principles applied are laid down in the Remuneration Policy.

- Performance orientation and differentiation: VP Bank remunerates employees according to their performance.

- Gender- and age-neutral remuneration and equal treatment: the function determines the level of the fixed annual salary.

- Fair and market-oriented pay: VP Bank is guided by market conditions and regularly reviews these.

- Focus of decision-makers on a stable, success-oriented and forward-looking management system and the avoidance of excessive risk-taking: VP Bank rewards sustainable positive actions and does not maximise revenues on a short-term basis.

With these principles, VP Bank ensures a remuneration which is in line with the market, with performance and with requirements. They set the right performance incentives for individual employees and management, thus fostering the achievement of the goals set out in VP Bank’s strategy. Remuneration-related conflicts of interest of the involved functions and/or individuals are avoided.

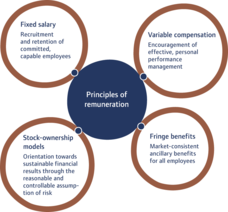

Structure of total remuneration

The total remuneration of the employees of VP Bank Group comprises a fixed remuneration, an additional variable salary, equity-share participation models as well as additional perquisites (“fringe benefits”).

Fixed salary

The level of the fixed salary component as a base salary varies in principle according to the function performed and the related requirements. The local labour market is also taken into account. The fixed salary is a contractually agreed salary component which is paid out regularly in cash. The level of the fixed remuneration ensures that the employee does not become financially dependent on variable compensation components.

Variable, performance- and profit-related salary

Variable remuneration can, but does not have to be granted. Even after repeated payouts, there shall be no entitlement to a variable salary payment in the following year.

On the one hand, variable compensation is dependent on the success of the Bank or individual companies and, on the other hand, on individual performance. The latter is evaluated by the employee’s supervisor at the end of a year on the basis of the agreed tasks and goals. The extent to which all relevant provisions of the legislator, the Bank and the individual client are observed is taken into account. The level of profit participation is fixed according to quantitative and qualitative criteria and is in reasonable relationship to the fixed portion of income. The target proportion to total remuneration varies according to function and market practices.

Payment is made in principle in cash in the first quarter of the following year and, as a general rule, in the full amount. In the case of particularly high variable salary portions, VP Bank may spread a part of the payment thereof over several years and/or settle a part in the form of VP Bank shares or vested entitlements thereto.

Participation models

Each year, equity shares are offered to the employees of VP Bank on preferential terms. The number thereof depends on the level of the fixed salary as of the measurement date of 1 May. The shares may not be disposed of during a sales restriction period of three years.

The Board of Directors modified the participation in VP Bank Ltd by members of the first- and second-levels of management and laid down two new programmes from 2014 onwards. The Performance Share Plan (PSP) is a long-term variable management participation programme in the form of bearer shares of VP Bank Ltd. It is based on the risk-adjusted profit (operating annual result adjusted for non-recurring items, minus capital costs), weighted over three years as well as the long-term commitment of management to a variable compensation component in the form of equity shares. At the end of the plan period and depending upon performance, 0 to 200 per cent of the allocated vested benefits will be transferred in the form of shares. At the beginning of the plan, the Board of Directors lays down the goals, the return on equity (RoE) and the cost/income ratio (CIR) to be achieved.

The Restricted Share Plan (RSP) is based on the risk-adjusted profit weighted over three years and is settled in equal annual instalments in the form of equity shares over the three-year plan period. The RSP programme may also be implemented in justified cases in order to remunerate a deferred variable salary portion or to implement particular retention measures.

A more detailed description of the “Performance Share Plan” and “Restricted Share Plan” management programmes can be found in the chapter on corporate governance under “Compensation, shareholdings and loans” .

Fringe benefits

Fringe benefits are ancillary benefits which VP Bank offers its employees on a voluntary basis, often as a result of practices which are customary in the given location or business segment. In principle, the bene- fits are only of a minor nature. They are settled and reported in accordance with local regulations.

They relate principally to the following benefits:

- Insurance benefits in excess of legal prescriptions

- Retirement-benefit-related amounts, in particular voluntary employer contributions

- Preferential conditions for employees in the case of banking transactions, such as reduced-rate mortgages for residential property

- Further fringe benefits which are customary in the given location

Individuals and functions subject to particular provisions

Employees who have a particularly large influence on the risk profile of the Bank are designated as “risk takers”. VP Bank identifies the members of the Executive Board as decision-makers and substantial “risk takers” as well as selected functions in the second management level. These are, in particular, the heads of the “Group Internal Audit”, “Group Legal, Compliance & Tax”, “Group Finance & Risk”, “Group Treasury & Execution”, “Group Information Technology” as well as “Group Human Resources Management”. Details of the remuneration of Executive Board members are set out in the section on corporate governance .

Individuals performing compliance and control functions are predominantly remunerated with fixed compensation components. Their variable compensation elements do not depend on the success of the business units which they audit or monitor.

Compliance with remuneration provisions

VP Bank’s remuneration practices are in compliance with Annex 4.4 of the Banking Ordinance (BankV) as well as the EU Directive. They are oriented towards long-term success. There are no events which trigger the automatic payment of variable salary components. The decision concerning the earmarking of a total amount for remuneration lies ultimately with the Board of Directors.

VP Bank does not make guaranteed payments in addition to fixed salaries such as end-of-service indemnities agreed in advance. Special payments upon commencement of employment may occur in selected individual cases – as a general rule, these relate to compensation for foregone benefits from the previous employer.

The Remuneration Policy allows for individual performance agreements in specific cases in order to calculate the amount of a bonus depending on an objectively measurable success. Group Executive Management must consent to the related method of calculation. The safeguarding of client interests and compliance with all regulatory directives must continue to be ensured in an unequivocal manner.

In application of Liechtenstein law, variable salary components may be cancelled if necessary, those withheld be forfeited or those already paid out reclaimed. This applies, in particular, in the case of proven guilt of an employee or the acceptance of excessive risk to achieve goals.

The sum of variable-salary provisions must be tolerable in the aggregate. VP Bank Group or an individual subsidiary company should never fall into financial difficulty as a result thereof. In the case of adverse trading conditions, the Bank shall refrain from paying variable remuneration components.

Determination of remuneration (governance)

By consenting to the budget, the Board of Directors approves the total fixed remuneration and, at the end of the year, decides on the level of provisions for the variable salary components with regard to the annual results. It lays down the fixed and variable portion of remuneration for the members of Group Executive Management and the Executive Board. The Nomination & Compensation Committee (NCC) supports the Board of Directors in all issues involving the setting of salaries, defines, together with Group Executive Management, those individuals designated as “risk takers” and monitors their remuneration. Together with Internal Audit, the NCC reviews compliance with the Remuneration Policy.

Group Executive Management is responsible for all aspects involving the implementation of compensation processes within the scope of the Remuneration Policy and lays down the framework thereof for the individual companies. It specifies the fixed and variable remuneration of the second-management-level heads, including the managers in charge of subsidiary companies. Furthermore, it issues annual implementing regulations to the companies and/or supervisors for the fixing of individual variable salaries. The individual supervisors agree on tasks and goals as part of the MbO process and evaluate the achievement of goals at the end of the period. In addition to performance, particular attention is paid to the observance of all relevant regulatory provisions.

Quantitative information on remuneration

Information on the remuneration of members of the Board of Directors as well as the members of the Executive Board can be found in the financial report, the stand-alone financial statements of VP Bank Ltd, Vaduz, under “6 Personnel expenses”

Aggregate compensation paid to all risk takers in 2014 amounted to:

| CHF | Share of |

Fixed base salary | 3,633,462.00 | 52.1% |

Short-Term Incentive (STI, cash) | 805,000.00 | 11.5% |

Restricted Share Plan (RSP) entitlement for performance year 2013 | 668,000.00 | 9.6% |

Performance Share Plan (PSP) | 1,487,000.00 | 21.3% |

Management pension fund employer contributions | 381,269.35 | 5.5% |

Total compensation | 6,974,731.35 | 100.0% |

|

|

|

Vesting 2014, share value PSP 2011–2013 | 459,568.95 |

|