VP Bank’s investment process

VP Bank is committed to an active investment approach. This approach is based on a transparent and institutionalised investment process, for which the decision-making process is systematic, well-documented and based on clearly defined responsibilities.

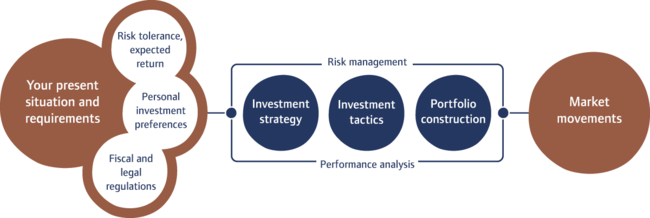

The structure of the VP Bank investment process

The investment process covers all activities involving the construction, management and risk control of financial assets in a client portfolio. In this regard, portfolio composition plays a central role.

Experience shows that more than 90 per cent of investment performance is determined by the asset structure. When implementing the allocation, the selection of the actual instruments plays only a very minor role in a diversified portfolio.

The portfolio is constructed by selecting either individual instruments (bottom-up) or markets (top-down).

VP Bank’s investment process is largely based on a top-down approach. VP Bank therefore initially determines the desired portfolio orientation. The actual products are then selected.

The investment process consists of three steps:

- Strategy: The starting point is the definition of the long-term, strategic investment allocation. This allocation is determined on the basis of the client’s risk tolerance and expected return and is specific to each investor. The strategy is reviewed annually.

- Tactics: In the second step, VP Bank adjusts the long-term strategic weightings based on the respective current market assessments. While the market analysis represents an ongoing activity, adjustments to the tactical allocation are made on a monthly basis.

- Implementation: The third step involves the actual portfolio construction, i.e. the specific selection of financial instruments. Based on the tactical market assessment, VP Bank selects the instruments that enable the optimal and consistent implementation of the market assessment.

As part of the investment process, the VP Bank Investment Research team is responsible for developing and formulating the market assessments.

The Investment Tactics Committee is responsible for the tactical positioning. The formulated market opinion serves as the basis for the individual investment solutions; in this regard, the individually defined portfolio risks are factored into the respective investment mandates.

VP Bank oversees the entire investment process through an Investment Controlling unit that is independent of management. Risk analysis is therefore performed prior to the investment decision. VP Bank’s Investment Controlling unit subsequently controls all results using performance analysis.

The selection process

Based on the strategic and tactical guidelines, the portfolio construction aims to select appropriate investment instruments in order to reproduce the weighting targets for the respective investment classes.

VP Bank Group follows two principles in this regard:

- Market efficiency: In markets where little added value can be achieved through active securities selection, the Group uses cost-effective, passive investment opportunities such as Exchange Traded Funds (ETFs). The choice of provider also plays an important role in this regard. VP Bank focuses on relative performance that closely tracks the respective benchmark, low administrative costs and ample fund liquidity.

- Best manager selection: In markets where active managers can generate added value and it is also possible to identify such providers, VP Bank looks to select such a fund manager. As part of its management and consistent with the top-down approach, VP Bank applies an allocation based on a broad number of asset classes. For the implementation, the selection of a corresponding specialist for a given asset class is essential.

VP Bank applies clear and comprehensible selection criteria and avoids conflicts of interest. It offers its clients access to the best managers and most promising product solutions. For the selection, qualitative criteria based on manager interviews are used along with quantitative criteria backed by professional and proven analytical tools.

- The process starts with professional peer group management in order to ensure that funds are only compared if they pursue comparable strategies and styles.

- Preselection by quantitative screening subsequently takes place by means of an analytical tool known as Fund Radar. Various relevant factors pertaining to risk and return are analysed and evaluated here.

- VP Bank then conducts a detailed analysis for every fund using the Fund View analysis tool in preparation for fund manager interviews.

- VP Bank utilises questionnaires (so-called RFPs) for ongoing manager interviews and documents the results systematically.

- Fund Navigator is a qualitative assessment tool which enables VP Bank to systematically compare qualitative data.

- The final rating is the result of analysing all (measurable) quantitative and (assessable) qualitative data.

Added value for the investor

As part of its management and consistent with the top-down approach, VP Bank applies an allocation based on a broad number of asset classes. For the implementation, the selection of a corresponding specialist for a given asset class is essential. Only in this manner can VP Bank ensure an optimal combination of the Bank’s top-down competencies and the manager’s bottom-up capabilities on behalf of the client.

VP Bank Group’s structured, integrated and investor-oriented investment process along with the consistent focus on best manager selection ensure that the client’s investment requirements play a central role and that the Bank acts as a reliable partner even during crisis periods.