Strategic orientation of VP Bank

Diversified business model and target markets

VP Bank’s business model is based on two strategic pillars: the intermediaries business and private banking. The Liechtenstein home market also includes the retail and commercial banking activities. In addition to these core competencies, VP Bank Group has its own international fund competency centre. Thanks to the valuable synergies between the respective business segments, VP Bank can offer its clients attractive value added across a broad range of services.

VP Bank Group has international offices in six financial centres: Vaduz, Zurich, Luxembourg, Singapore, Hong Kong and Road Town (BVI). From these locations, VP Bank actively cultivates its defined target markets and client segments, differentiating between the intermediaries business and private banking activities.

VP Bank’s primary strategic goal is to pursue profitable and qualitative growth through its activities in the target markets and thereby ensure its independence. To that end, VP Bank Group offers a comprehensive line of services that correspond to its business model.

VP Bank distinguishes between three market categories. The target markets are relevant for the entire Group and are actively developed across all segments. Opportunity markets are those offering concrete growth potential and where market penetration is pursued through site-specific initiatives at reasonable cost. Clients in Other markets – mainly in the intermediaries area – are offered cross-border services upon request, to the extent allowed by regulations, on a passive basis.

The target markets for Europe include Liechtenstein, Switzerland, Germany, Luxembourg, Russia and Ukraine. In Asia, they include Singapore, Hong Kong, Indonesia, Malaysia and Thailand. Each site is responsible for the market penetration efforts, which are coordinated at Group level.

In October 2018, as part of the review of its market development strategy for the Russian market, VP Bank closed its Moscow representative office in order to generate further productivity gains while reducing the complexity and cost of internal processes. Russia remains a primary target market of VP Bank Group; the market development efforts are carried out mainly at the Zurich site as the competency centre for Central and Eastern European markets.

Strategy 2020

In 2015, the Board of Directors and Group Executive Management developed the “Strategy 2020” business plan. Based on this plan, the Board of Directors defined the medium-term goals through end-2020 as follows:

VP Bank’s medium-term goals

CHF 50 billion in client assets under management

CHF 80 million in consolidated net income

Cost/income ratio of less than 70 per cent

The 2020 strategy consists in three pillars with a long-term approach:

Growth

In order to achieve its defined growth targets, VP Bank is pursuing a dual growth strategy.

Through organic growth, VP Bank aims to win new clients in its target markets and expand the current client base in order to further increase client assets under management. We will achieve this objective by actively strengthening the Bank’s positioning in the all-important financial intermediaries business, expanding the private banking business and further building up the fund business.

Organic growth will also be supported through the addition of new client advisors. This approach was the impetus for the “Relationship Manager Hiring” project initiated in late 2016. This project seeks to hire a total of 75 new client advisors by end-2019, with roughly one half hired at the Bank’s Asian sites and the other half in Switzerland/Liechtenstein/Luxembourg. In 2018, a total of 24 new client advisors joined VP Bank (2017: 24), thereby helping to generate satisfactory new cash inflows. As regards projects, we continued to optimise back-office processes in order to handle the increased growth.

Along with organic growth, VP Bank intends to use its very strong equity position to invest in growth through acquisitions and joint ventures.

VP Bank also aims to pursue growth through continued international diversification. The earnings contribution from the international sites will be increased to 50% of the total over the medium term.

Focus

We use the term “focus” to refer to productivity gains and reduced complexities and costs for internal processes. In particular we will also take advantage of changing technological capabilities. The resulting productivity gains are reinvested in the growth and digitalisation strategy. VP Bank has established cross-functional teams to carry out the implementation.

Among other factors, this approach is based on efficient and dependable core banking services at low prices, ideally on a digital and automated basis.

The identification of potential cost savings within the Group was successfully implemented in recent years. VP Bank has largely completed the necessary measures related to the various projects. The knowledge gained in this process has been applied to an on-going cost management approach and resulted in more focused product and service lines.

Culture

The third pillar of Strategy 2020 relates to VP Bank’s culture. In this regard, VP Bank has identified two key areas: a sales and performance culture as well as the overall corporate culture.

The measures aimed at strengthening the sales and performance culture include our goal of further raising the advisory quality offered by our employees. They receive support through advisory tools such as Finfox as well as training programmes and certifications.

Last year as in 2017, broad-based leadership seminars with training sessions and workshops on the topic of management culture were held for managers in all business segments and at all office locations. The leadership programme is divided into four modules, and in 2018 the “Competent to lead” module was offered along with the “Lead to perform” workshop. These measures help to secure VP Bank’s cultural values, foster commitment, support managers’ continuing development and promote the active sharing of experiences.

Our corporate culture is based on skilled, motivated and service-oriented employees. VP Bank creates a good workplace and work environment, one in which employees are encouraged and can play an active role in shaping the company. In that regard, four themes emerge:

- Work and working environment

- Active participation by the Bank

- Encouraging employees

- Shared experiences

VP Bank conducts employee surveys every two years in order to stay informed about conditions for employees. Thanks to the high survey return rate, we can introduce targeted improvement measures.

Since 2015, the Bank has implemented the “myContribution” idea and innovation management policy. All employees are asked to play an active part in shaping VP Bank and to submit ideas on how to improve the Bank.

VP Bank also supports its employees in their efforts to broaden their technical skills, either through functional training such as certifications for client advisors or through continuing education on an individual level.

In order to strengthen the “team” approach, we created the “VP Bank Journeys” programme in 2017. Employees from throughout the Group get an up-close view of the innovation culture at other companies through company visits to other European cities.

A comprehensive overview of all measures for employees is provided in the section “Employees of VP Bank” on page 43.

Organisational structure

In 2018, VP Bank Group adapted its organisational and management structure and reassigned the tasks within Group Executive Management. These changes were made in accordance withJ the Strategy 2020. More detailed information is available under “The organisational structure of VP Bank Group” on page 14.

Executive management is supported by a broad second-tier management level consisting in 20 people.

Intermediaries strategy

VP Bank was founded in 1956 by Guido Feger, one of the leading trustees in Liechtenstein. From the outset, VP Bank therefore saw its role as a dependable and competent financial partner for intermediaries. VP Bank focuses on large, internationally oriented trustees as well as medium-sized external asset managers.

To be successful in this demanding segment requires the Bank to respond to changing client needs in Europe and Asia, satisfy regulatory requirements and notably take advantage of technological developments in the process.

For its intermediaries business, VP Bank Group uses a hybrid business model. Basic banking services on behalf of the end customers of intermediaries are designed to be as efficient, dependable and cost effective as possible using digital channels. The Bank then offers high-quality advisory services for intermediaries and end clients.

Along with the traditional custody business, the bank offers end clients comprehensive investment advisory, asset management, wealth planning and lending solutions.

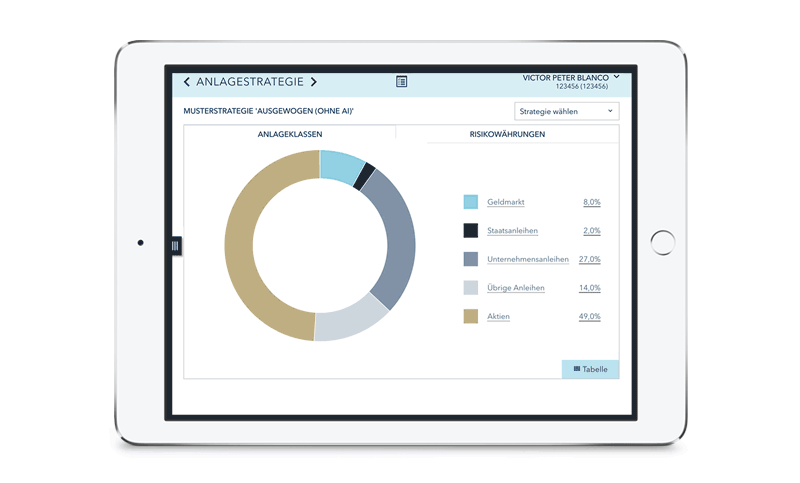

Specialised IT solutions such as e-bankingplus are offered specifically to intermediaries. With the ProLink information platform, intermediaries clients have a simple and speedy way to access the most important information and services they need for their daily work. These include extensive coverage of financial market events, regular publications on business and economic issues, the latest news on tax and regulatory developments as well as all required forms.

VP Bank also offers complete fund solutions, from advisory to risk management to fund administration. The exclusive investment and trading services complete these offerings, enabling intermediaries to make use of a variety of services. They can thus access comprehensive market research and publications, review their existing positions as part of a “Wealth Health Check” or receive investment advice or get direct access to trading experts through VP Bank’s “active advisory” as needed. We also help clients select appropriate funds or structured products. Along with investment and trading services, VP Bank offers comprehensive advisory on issues such as legal, compliance and taxes.

With its five international booking centres, VP Bank is one of the few banks of its size to have this unusually broad global presence. We offer our clients substantial value-added through our comprehensive offerings.

Private banking

In private banking, VP Bank focuses mainly on the defined client segments High Net Worth Individuals (HNWI) and Ultra High Net Worth Individuals (UHNWI). In the Liechtenstein home market, the Bank also supports the Affluent Client and Retail Client segments.

VP Bank offers its clients a broad range of personalised solutions from investments to financing to wealth management and asset structuring.

Digital banking services were expanded in 2018. A new e-banking platform was launched and specific processes such as account opening and closing were automated. Client advisors were also equipped with iPads.

The advisory process was enhanced with the “Finfox” application. This tool makes it possible to perform wealth management and investment planning in a timely and efficient manner. Finfox gets the client involved interactively in the investment advisory process and enables direct implementation of investment decisions.

Fund business

The fund business plays a central role at VP Bank. It complements the private banking and intermediaries businesses and represents an attractive growth segment.

The fund business encompasses the activity with third-party funds and proprietary funds and is managed under the VP Fund Solutions umbrella. With VP Fund Solutions, VP Bank Group has an innovative and dynamic international fund competency centre and a one-stop shop for all services related to the fund business. The competency centre is comprised of VP Fund Solutions (Liechtenstein) AG and VP Fund Solutions (Luxembourg) SA, with the Group-wide management of this strategically important business based in Luxembourg.

With 20 years of experience, VP Fund Solutions offers close, cross-border teamwork with locally and internationally renowned asset managers. Through its cooperation with VP Bank, which acts as custodian bank and paying agent, VP Fund Solutions has access to VP Bank Group’s international reach and cost-optimised network of depositories for the clearing and settlement of fund managers’ investment decisions.

The geographic focus of VP Fund Solutions lies in Germany, Liechtenstein, Switzerland, the Benelux countries, Scandinavia, the United Kingdom and Asia. The initiators and clients consist in external asset managers and family offices.

2018 was a particularly successful year for our fund business, which confirmed the relevance of our “one stop shop” strategy. VP Fund Solutions is the number 1 private label fund manager in Liechtenstein and a recognised and sought-after third-party management company in Luxembourg. In 2018, the profit from new clients grew above the market average.

Lending strategy

In a competitive environment of falling earnings and rising costs, clear differentiation is a decisive factor for success. VP Bank Group’s lending business is a key feature that sets it apart from other traditional private banks. It is further enhanced by the Bank’s flexibility, agility, short decision-making channels and trusted client advisors familiar with mind-set of the clients in the respective markets.

For many years, the lending business has served as a steady, dependable source of income for VP Bank Group; it provides a significant and stable earnings contribution.

The lending strategy is an integral part of VP Bank Group’s service offerings. It is conceived in accordance with the strategies of the two strategic business segments, private banking and intermediaries, as well as market strategies and is aligned with them. We offer standard financing for retail and corporate clients. The lending business provides substantial support to the organic growth of the private banking and intermediaries business by expanding the financing offerings on the one hand and by fostering closer and more sustained client ties on the other.

The growth of client assets in the international business continues to trend favourably, in contrast to the situation in the saturated European markets. We take advantage of this trend and adjust our credit offerings to the respective market and client needs while securing our position in with local businesses as a skilled and reliable financing partner.

The continued development of the lending business is essential for VP Bank Group to achieve its medium-term goals. This development should consist in both organic growth as well as mergers and acquisitions. In that regard, we strive to provide a line of credit products tailored to the market and clients at the various booking sites.

Digitalisation strategy

The relentless trend towards digitalisation and the increasing significance of IT-based processes and solutions – both in the intermediaries business and in private banking – call for a strategic approach, one that VP Bank is systematically executing within the framework of its digitalisation strategy. This involves an across-the-board modernisation of the communication channels with clients and employees as well as a broadening of the Bank’s online offerings.

For example, VP Bank has started to apply a hybrid advisory model that combines tried and true personal financial consulting with modern technologies and digital services, in which tools that support the client advisors and various client segments play a central role.

As part of the trend toward digitising processes, data and communications channels, we introduced numerous measures that have been implemented steadily since 2016. The main focus is on solutions that can be implemented on a Group-wide basis and standardised.

VP Bank has identified concrete action fields to be implemented as part of a Group-wide programme. This will be accomplished in two phases:

The first phase centres on technical modernisation of the existing online services as well as specific functional improvements for all VP Bank client segments. In that regard, the use of online services will be made simpler and usability and convenience will thereby be enhanced. In the spring of 2018, the redesigned client portal combined with expanded e-banking features was launched and will continue to be expanded according to client needs.

In a second phase, VP Bank is making targeted investments in its internal systems and databases so that advisors have more time to support their clients and make the right decisions together. Following an extensive analysis, the number of client advisor positions will be steadily expanded in the coming two years in order to better serve the various needs of our clients.

Asia strategy

The Asia/Pacific region is one of the most important growth markets for private banking and is one of the identified target markets where VP Bank sees attractive growth opportunities. VP Bank has positioned itself as a “boutique bank” that provides first-class solutions to satisfy demanding standards.

In Asia, VP Bank is represented in the major financial centres. It has an asset management company and representative office in Hong Kong as well as a branch in Singapore with around 80 employees. The Bank’s business model in Asia is also based on the two strategic pillars of private banking and intermediaries. The target markets include Southeast Asia, notably Singapore, Hong Kong, Indonesia, Malaysia and Thailand. The client segments range from high net worth individuals with at least SGD (Singapore dollar) 1 million in assets to ultra high net worth individuals.

The growing number of intermediaries clients in Asia also creates promising opportunities. In this segment, VP Bank offers its clients regionally oriented service models for trustees and external asset managers as well as personalised support. The development of strategic partnerships is also being advanced. Clients benefit from direct market access to VP Bank’s trading desks in Singapore and Liechtenstein/Switzerland, which cover the major time zones.

In recent years we have noticeably expanded our presence in Asia. 2018 marked VP Bank’s 10 year anniversary in Singapore, and in April of that year the Bank doubled the size of its office space in order to keep pace with growth and have room for further expansion. The number of employees in Singapore rose by 49 to 72 in 2018.

We are expanding our Singapore branch by adding advisors in the investment advisory, wealth consulting and estate planning areas. In 2018 we also significantly expanded our product line with specific offers for our Asian clients.

In 2018 the subsidiary VP Bank (Singapore) Ltd was converted to a branch and the banking license was upgraded from merchant bank to wholesale bank in order to implement VP Bank’s growth strategy in Asia in a more targeted and efficient manner. As from 1 September 2018, VP Bank’s business in Singapore is conducted by our branch, VP Bank Ltd Singapore Branch.

Brand strategy

A good brand uses the company’s strengths and potential. It creates an emotional connection by appealing to the sensibilities of the target group. A truly strong brand requires the courage to seek differentiation.

A consistent brand experience is important to convey a unified corporate identity both within the company and externally. All points of contact with VP Bank must therefore be configured to act as brand ambassadors. That way we achieve a thoroughly consistent experience, one that enables us to stand clearly apart from the competition and gain a competitive advantage.

VP Bank’s brand elicits emotions, creates connections and offers guidance. It also instils a sense of identity for our employees.

VP Bank’s brand is comprised of two fundamental components: the brand strategy by which our brand positioning is defined and the brand design through which a highly unique identity is achieved. The goal of our strong brand is to create a clearly recognisable image for all stakeholders from both a content and visual perspective.

VP Bank constantly develops and adjusts the brand components as needed. As regards content, the most recent change occurred in 2017 when the brand focus was refined in order to clearly define what VP Bank stands for and does.

The respective hierarchies of the VP Bank brand are shown in the brand pyramid as the basis for our common action. It includes all the components of the vision and mission up to our conduct and our promise.

More detailed information on our brand identity can be found on our website under “About us / VP Bank Brand”: www.vpbank.com/brand

A look back at the successful groundwork: 2008–2018 strategy

In 2008, VP Bank conceived its “Strategy 2018”. This strategy included the creation and systematic development of the “private banking clients” and “intermediaries” business units. It was made in response to a structural shift in the global distribution of assets and it substantiated the growing relevance of markets in the Near East, Eastern Europe and Asia.

We steadily and consistently implemented the 2008 strategic orientation; the core business segments “Private Banking” and “Intermediaries” have grown very successfully. Valuable progress was also made through organic growth and acquisitions. Thus in 2013 VP Bank acquired the private banking activities of HSBC Trinkaus & Burkhardt (International) SA as well as the private banking-oriented fund business of HSBC Trinkaus Investment Managers SA in Luxembourg. Then in 2015 it acquired and integrated Centrum Bank in Liechtenstein, whose former sole shareholder Marxer Stiftung für Bank- und Unternehmenswerte is now a core shareholder of VP Bank Group. In 2018, VP Bank penetrated the Scandinavian market through the acquisition of the fund management and custody activities of Luxembourg-based Carnegie Investment Funds as well as the Luxembourg private banking activities of Sweden’s Catella Bank.

The continuous expansion of the Asian sites in Singapore and Hong Kong during the past 10 years shows their major importance and enables us to provide local support to clients in the Asian target markets. The business activities with Eastern European clients was also expanded steadily according to plan.

Outlook

Growth remains a central concern for VP Bank in 2019. The “Relationship Manager Hiring” programme runs through end-2019 and continues the steady expansion of the advisor teams in the intermediaries and private banking segments. Along with organic growth, we would also like to use the very strong equity position to invest in growth through acquisitions.

A key focus is the continued development of our digitalisation strategy. We will undertake the following projects in 2019:

Implementation of the digitalisation strategy with a focus on improved service offerings for our clients

Continuous process improvements in order to support the growth of our Bank sustainably and efficiently

Implementation of more efficient compliance solutions in order to satisfy growing regulatory requirements

Implementation of additional regulatory requirements such as FIDLEG in Switzerland

Under the banner of “Future of Banking” we are working to prepare the future of VP Bank Group. The corresponding themes include networking with partners, multi-channel communications and interaction as well as artificial intelligence.

The importance of our Asian business will continue to grow. We are therefore investing in this area. The Singapore branch serves as a platform for future growth in this regard.

Following the acquisition of the investment funds of the Swedish financial services group Carnegie as well as the transaction with Catella Bank S.A., we have added another focal point for the growth of our activities in the Scandinavian market in 2019.

The investment business represents a key pillar for the successful implementation of our growth strategy. The environment marked by low interest rates, persistent and significant political uncertainty and new developments in the area of big data and artificial intelligence make it necessary and possible to create new solutions that allow us to support our clients optimally as they seek to achieve their financial goals. This objective goes hand in hand with our brand strategy in order to ensure recognisability.

The implementation of sustainable products and services and the expansion of our proprietary fund products are other growth drivers for 2019.

The sharp increase in net new money inflows at VP Bank Group in 2018 confirms the relevance of our strategic orientation. VP Bank will therefore continue its pursuit of broad-based growth.