VP Bank Group shares

Economic outlook

Growth expectations for 2013 were not entirely fulfilled. For instance, the International Monetary Fund saw fit to reduce its global economic growth forecasts several times during the course of the year. On balance, the world economy grew by a mere 3.0 per cent, a figure lower than that of the previous year. Despite this, 2013 was a successful year from a business perspective. There were hardly any major natural catastrophes. In the peripheral states of the Eurozone, there were initial glimmers of hope after the hard times they have suffered in recent years. Positive growth rates were recorded in countries such as Portugal, and other states, notably Greece, showed signs of stabilising.

While the Eurozone gradually moved on from the recent crisis, the economic landmines shifted to the USA. America’s two major political parties were unable to agree on a budget, which is why at the beginning of the new fiscal year on 1 October, many US federal agencies were forced to temporarily stop work. The so-called “government shutdown” lasted until 16 October, when a temporary compromise was reached. To the amazement of many economists, this political stalemate left only minor bruises on general business activity: the key leading indicators of the world’s largest economy continued to trend higher. According to preliminary calculations, the USA’s domestic product rose by 1.9 per cent in 2013 – a solid reading given the strict US government cutbacks.

Amongst the industrialised nations, the Swiss economy proved to be extremely robust: with a GDP growth rate of 2.0 per cent, Switzerland managed to avoid the difficulties in the surrounding Eurozone. High levels of construction activity and buoyant private spending were the main reasons for this anomaly. The Swiss National Bank (SNB) stayed its charted course by resolutely defending the 1.20 exchange-rate floor versus the euro.

Thanks to inflation rates which, from a historical standpoint, remain moderate, the major central banks were able to stick to their expansive monetary policies. In November 2013, the European Central Bank (ECB) cut its benchmark lending rate to a new all-time low of 0.25 per cent, and at its December meeting, the US central bank’s Federal Open Market Committee (FOMC) resolved to reduce its monthly purchases of securities by USD 10 billion to USD 75 billion. As speculation about such a move had already arisen last spring, thereby causing considerable turbulence in the financial markets, investors took the December FOMC decision with a pinch of salt. The Fed announced that further tapering would be handled cautiously, further adding that the base lending rate would remain close to zero for quite a long time, a statement echoed by all major central banks. In light of Switzerland’s very low inflation rate, it is also unlikely that the SNB will raise interest rates any time soon.

Equity markets

2013 was an outstanding year for equity investors. The global benchmark index (MSCI World AC) recorded a gain of more than 20 per cent, its strongest performance since 2009.

The reasons for the sharp price gains are manifold. The seemingly never-ending discussion surrounding the European debt crisis faded into the background, while today’s negative real interest rates have forced many investors to opt for riskier asset classes.

Fundamentally, corporate profit levels have also increased, but the recent price gains are mainly attributable to nothing more than an expansion of valuations (i.e. higher price-earnings ratios). What at the beginning of the year were considerable valuation discounts compared to historical levels were largely dissipated during the course of the year.

While the equity markets of industrialised nations generally marched to the same drum, those in the emerging nations broke rank by falling by average of almost 5 per cent. One reason for this rather unusual divergence is the fear amongst many investors of an impending monetary policy shift. In response, those investments perceived as being especially risky were sold practically across the board, a wave of selling that struck emerging nations’ shares, bonds and currencies.

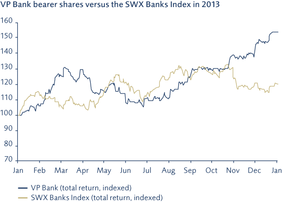

The shares of VP Bank Group

VP Bank Group shares have been listed on Switzerland’s stock exchange (SIX Swiss Exchange) since 1983. The company’s average market capitalisation in 2013 amounted to CHF 569 million. Banks were amongst the beneficiaries of the favourable overall market trend. Expressed in Swiss francs, the global banking index (MSCI World Banks) recorded a gain of roughly 22.5 per cent (including dividends) in 2013. With a return of 25.9 per cent for the year, European financial institutions in particular benefited from the revival in investor risk appetite.

VP Bank Group stock was a clear outperformer. With a year-on-year performance of 50.0 per cent, the shares now stand at a level (including dividends) they last saw in the summer of 2011. The price gains were achieved only in the 3rd and 4th quarters. The annual high of CHF 97.5 was hit at year’s end (December) and the low of CHF 63.5 at the beginning of the year (January). The average price for the year was CHF 78.6.

Investor relations

The goal of VP Bank Group’s investor relations efforts is to foster an open, ongoing dialogue with shareholders and other capital market participants by providing them with a true and fair view of VP Bank Group, while also informing the interested public in a prompt manner about the latest developments at the company.

The tasks involved in this investor relations work include conducting discussions with analysts and investors, disclosing ad hoc information regarding business issues of relevance under securities law, producing the company’s annual and semi-annual reports and publishing the related financial results, as well as organising the annual general meeting of shareholders. In 2013, the investor relation activities were intensified. Numerous analyst and media conferences were key events for intensifying the communication with investors and financial intermediaries. The first-ever Investors’ day in Liechtenstein is planned for 2014.

Regular presentations addressing the current trend in financial results serve to enhance the dialogue with institutional and private investors. An additional means of communication is the website www.vpbank.com, where all up-to-date information on VP Bank Group can be accessed.

The 2012 annual report of VP Bank Group received a number of awards in 2013. It was awarded gold as part of the international “ARC Awards” as well as by the “League of American Communications Professionals” in its ratings of corporate annual reports. It came away with “silver” from the “Vision Award Annual Report Competition”. Also, the completely redesigned online annual report of VP Bank Group found international acclaim: in America’s “Vision Awards” and “Stevie Awards” competitions, VP Bank Group won “bronze” in the category “Best Annual Reports”. These awards attest to the high quality of VP Bank Group’s information policy.

In September 2013, Standard & Poor’s maintained its “A–“ (A–/A–2) rating of VP Bank Group, thereby underscoring the solid creditworthiness of the institution. In its report, Standard & Poor’s makes special note of VP Bank Group’s outstanding capital base which, following publication of the 2013 semi-annual results, the rating agency newly deemed to be “very strong”. Accordingly, S&P upgraded the outlook for VP Bank Group from negative to stable. Moreover, it paid tribute to the operative improvements which are being reflected in increasing revenues and decreasing costs. The report also pointed out the strategic progress we have made by focusing on our core competencies in private banking and the financial intermediaries business.

This unchanged, gratifying “A–” rating confirms the solid and successful business model of VP Bank Group. VP Bank Group is one of the few private banks in Liechtenstein and Switzerland that are evaluated by a major international rating agency.Research coverage of VP Bank Group is provided by analysts at Zürcher Kantonalbank.

Agenda for 2014 |

|

Media and analyst conference, | Tuesday, 18 March 2014 |

Annual general meeting | Friday, 25 April 2014 |

Dividend payment | Monday, 5 May 2014 |

Investors’ day of VP Bank | Thursday, 15 May 2014 |

Round-table discussion | Tuesday, 26 August 2014 |

|

|

VP Bank share details | |

Bearer shares, listed on SIX Swiss Exchange | |

Amount listing | 5,314,347 |

Free float | 68.69% |

Symbol on SIX | VPB |

Bloomberg ticker | VPB SW |

Reuters ticker | VPB.S |

Security number | 1073721 |

ISIN | LI0010737216 |

SEDOL number | 5968006 CH |

|

|

Share-related statistics 2013 |

|

High (27/12/2013) | 97.50 |

Low (07/01/2013) | 63.50 |

Year-end close | 97.50 |

Average price | 78.60 |

Market capitalisation in CHF million | 569 |

Consolidated net profit/loss per bearer share | 6.58 |

Price/earnings ratio (PE) | 14.81 |

Dividend per bearer share (proposed) | 3.50 |

Net dividend yield in % | 3.6 |

Standard & Poor’s rating | A (A–/Stable/A–2) |

Further information on VP Bank’s shares, capital structure and major shareholders can be found in the “Corporate governance 2013” section.

Contact

Tanja Muster - Head of Group Communications & Marketing

Tel +423 235 66 55 - Fax +423 235 65 00

investor.relations@vpbank.com

www.vpbank.com - Investors & Media