VP Bank’s clients

VP Bank pursues a clearly defined business strategy, the most important element of which is closeness to the client. Only those who are really in touch with their clients and know their needs precisely are in a position to respond appropriately to the latest market developments. Again in 2013, VP Bank invested considerable sums in direct client contact.

A clear specification of the roles involved in client service regulates the interplay between relationship managers and specialists for investment products and services, tax matters, credits, funds and foundations. Within the framework of a holistic advisory approach, each team draws upon competencies at Group level in order to devise individualised solutions that meet all requirements.

The advisory concept encompasses each and every phase of a client’s lifecycle. This differentiation makes it possible to provide a tailored range of products and services. VP Bank Group offers customised portfolio management services and investment advice to private individuals and financial intermediaries. Thanks to the abiding philosophy of open architecture, clients benefit from unbiased advice. Included in the recommendations are products and services of other leading financial institutions as well as the Bank’s own investment solutions.

VP Bank focuses squarely on client satisfaction and service quality. For that reason, the Bank carries out client feedback management activities that involve surveys of client satisfaction and regular reporting. Open feedback paths, professional complaint management and a continuous dialogue with clients are evidence of this resolute client orientation.

Business units and client segments

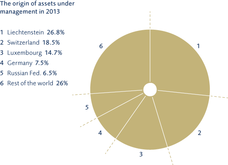

Through its Private Banking and Intermediaries business units, VP Bank addresses a defined and limited number of target markets and client segments. Private banking services and the intermediaries business are performed at all VP Bank locations. In Liechtenstein and the surrounding region, this range is supplemented with retail banking services that include client-oriented packaged solutions.

Also primarily in Liechtenstein, as well as in eastern Switzerland, VP Bank caters to institutional clients and regional companies in need of investment and operating finance. The younger target groups are addressed in particular by means of e-Channel initiatives. Youth packages for students and trainees round out the range of services on offer.

In terms of private banking, VP Bank’s focus is on the mid-range segment – in other words, individuals with total assets of between CHF 1 million and 25 million. Segmentation is made according to the utilisation preferences of clients, with correspondingly targeted offers.

New challenges

The world of private banking is in transition. Where the primary emphasis in the past was on investment advice and portfolio management, today, increasing focus is being placed on regulatory issues (MiFid, FATCA, tax compliance, etc.). The advisory process is taking place within the tug of war between an array of new regulatory decrees and the individual investment and wealth objectives of clients.

VP Bank has risen to this challenge. In addition to comprehensive training sessions for client advisors, the Bank’s clients are also being counselled by teams of specialists who, for example, contribute their vast know-how in tax matters to the discussion, thereby demonstrating the overall competence of VP Bank. Investing in the IT systems and adding personnel to the “Legal, Compliance & Tax” team also represent measures VP Bank is taking to optimise client service.

Crossborder banking

The legal and reputational risks involved in the crossborder financial services business have increased markedly in the recent past. Foreign supervisory authorities are keeping a keen eye on the legal conformity of foreign banks’ crossborder business activities, which include client acquisition, advice and service.

As VP Bank Group renders crossborder services, the Bank has regulated those activities in a binding “Crossborder Policy”. This directive serves as an adequate instrument for recognising, managing and controlling the related legal and compliance risks. It also lays down the principles as well as the ways and means by which the crossborder services and products of the Bank are to be offered.

For each of its target countries, VP Bank provides its client advisors with country manuals which describe the local behavioural dos and don’ts from a legal standpoint.

Advisory process

For optimal client care, VP Bank conducts a five-stage advisory process.

1. Win the client

The prerequisites for successful client acquisition are systematic planning, preparation and execution, whereas VP Bank wins most of its new clients as a result of recommendations by existing clients.

2. Understand the client

Understanding the client represents the basis for providing professional advice. The quality and quantity of information received from the client through direct questioning or in written form are decisive factors in the ability to identify the client’s needs and to develop fine-tuned solutions.

3. Advise the client

Once the needs of the client have been determined, the task is to present solutions. In arriving at those solutions, alternatives are always borne in mind. The client is not only shown the solutions that are “the closest fit”, but also sensible possibilities in a broader context. VP Bank attaches great value to a team approach in devising solutions. Accordingly, specialists as well as other sources of know-how are included in this process.

4. Implement the client’s wishes

If the client agrees with the proffered solution, implementation is the next step. The time taken for translating solutions into reality underscores VP Bank’s performance capabilities and devotion to achieving the exceptional. VP Bank considers it extremely important that the implementation of solutions is conducted in a timely manner or in keeping with agreed milestones that fulfil the expectations of the client.

5. Accompany the client

The advisory process does not merely end upon realisation of an agreed solution. A client profile changes steadily and is augmented to reflect new developments. By periodically comparing the client profile with the effects and performance of a previously agreed solution, genuine added value is generated for the client.

Investment recommendations

In its annual outlook for 2013, VP Bank recommended that its clients invest in riskier asset classes, despite the only moderate rate of economic growth. The rationale: due to their attractive valuations, those positions should ultimately benefit from a more stable environment.

This prophecy has essentially come true. Although little impetus was provided from the economic side, the reduction of extreme political and financial risks spurred the markets. Shares in particular recorded impressive gains in 2013, while secure government bonds had their difficulties. However, not all risky investments and regions experienced an upswing. The bull markets witnessed in the industrialised nations failed to materialise in the emerging markets. Nonetheless, those who chose to accept risk in 2013 were richly rewarded.

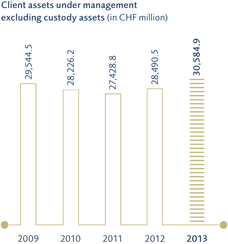

Client assets

As at 31 December 2013, VP Bank held client assets under management totalling CHF 30.6 billion (7.4 per cent more than in the previous year). An additional CHF 9.0 billion took the form of assets held in custody. Thus, total client assets on that date amounted to CHF 39.6 billion. In total, VP Bank Group recorded a net new money inflow of CHF 965 million (previous year: CHF 192 million outflow).