Consolidated Annual Report of VP Bank Group

Consolidated results

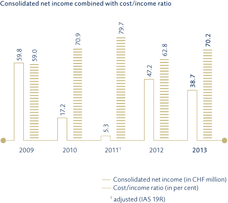

The consolidated financial statements for 2013 of VP Bank Group, prepared in accordance with International Financial Reporting Standards (IFRS), disclose a Group net income of CHF 38.7 million. In the prior year, the Group generated a Group net income of CHF 47.2 million. After adjusting for the non-recurring gain as a result of its conversion of the pension fund from a benefit-defined to defined-contribution scheme as well as the early adoption of the revised standard IAS 19 of CHF 22.8 million, the prior year’s net income totalled CHF 24.4 million. Group net income for 2013 thus increased by CHF 14.3 million or 58.6 per cent over the prior year’s adjusted net income.

In summer 2012, VP Bank Group resolved to refocus strategically on the middle private-banking segment and the business with intermediaries. As part of this process, the Board of Directors decided to dispose of the Group’s own trust and fiduciary companies. The subsidiary company, IGT Intergestions Trust reg. in Vaduz was disposed of by VP Bank Group as part of a management buyout and all employees were transferred to the existing company. VP Bank Group also streamlined the structures of its umbrella holding company VP Bank and Trust Company (BVI) Limited in Tortola on the British Virgin Islands, which was a joint venture with the Liechtenstein-based Allgemeines Treuunternehmen (ATU). VP Bank Group acquired the entire capital of VP Bank (BVI) Limited and the remaining participations were transferred to Allgemeines Treuunternehmen, Vaduz.

The successful acquisition, in the form of an asset deal, of the private-banking activities of HSBC Trinkaus & Burkhardt as well as the private-banking-related investment-fund business carried out by HSBC Trinkaus Investment Managers in Luxembourg to the amount of CHF 2.0 billion in client assets underscores the growth strategy of VP Bank.

Despite the fact that global economic growth could not pick up significantly from last year, 2013 was nevertheless a successful year from an economic perspective. The European debt crisis further receded against the backdrop of market activity and towards the end of the year, the Eurozone was able to emerge from the recession. Yet again, the national economies of Liechtenstein and Switzerland were able to assert themselves, and on financial markets, equity shares again rose sharply. The announcement of the US central bank’s wish to restrict its very expansive monetary policy triggered movements in interest rates on a global basis. These factors also impacted on the business of VP Bank and are reflected in both revenue and client activities.

VP Bank Group generated a net inflow of new client money of CHF 965 million for the whole of 2013. Client assets under management increased to CHF 30.6 billion as of 31/12/2013.

With regard to the improved profitability situation and the adapted dividend policy, the Board of Directors will propose a dividend of CHF 3.50 per bearer share and CHF 0.35 per registered share to the Annual General Meeting to be held on 25 April 2014.

Medium-term goals

In the medium term, VP Bank Group strives to achieve the following measures:

- a net new money inflow of an average of 5 per cent per annum

- a cost/income ratio of 65 per cent, and

- a tier 1 ratio of at least 16 per cent

In 2013, VP Bank Group achieved a positive inflow of new money. New client money inflows of CHF 965 million (3.4 per cent of client assets under management) were generated.

The cost/income ratio in 2013 increased to 70.2 per cent (prior year: 62.8 per cent). After adjusting for the non-recurring items in 2012, this equates to an improvement in the cost/income ratio from 72.5 per cent to 70.2 per cent. At the same time, total operating income grew by 1.8 per cent and adjusted operating expenses fell by 1.5 per cent.

In 2013, the tier 1 ratio declined from 21.5 per cent to 20.4 per cent due to the increase in total assets. VP Bank Group possesses a very good starting point, compared with other financial institutions, for its growth strategy, both organically as well as by way of acquisitions. The medium-term goal of at least 16 per cent which is far in excess of the legally prescribed level, was again far exceeded in 2013.

The future regulatory framework Basel III will impose stricter capital-adequacy and liquidity requirements on banking institutions. Even after the introduction of Basel III, VP Bank Group will continue to possess a robust core capital (tier 1 ratio), thus reflecting a high measure of stability and security.

Client assets under management

At the end of 2013, client assets under management of VP Bank Group aggregated CHF 30.6 billion. Compared with the prior year’s comparative of CHF 28.5 billion, this represents an increase of 7.4 per cent. The performance- related increase in client assets amounted to CHF 1.1 billion, as a result of the positive development in markets.

In total, VP Bank Group recorded a net inflow of new money of CHF 965 million (prior year: outflow of client money of CHF 192 million). This positive development is based in particular on the acquisition of client assets aggregating CHF 2.0 billion in connection with the HSBC asset deal. Through successful market-development activities, VP Bank Group was able to counter the net outflow in client money within the existing business. As a result of regulatory changes, in particular tax-related issues as well as a large outflow from a third-party investment fund, these inflows generated from the existing business were not able to fully compensate for the outflows.

Custody assets increased by 2.0 per cent to CHF 9.0 billion (prior year: CHF 8.8 billion).

As of 31 December 2013, client assets including custody assets totalled CHF 39.6 billion (prior year: CHF 37.3 billion).

Income statement

The year-on-year comparison of certain items is hampered by the one-off effects totalling CHF 22.8 million in 2012, arising from the conversion of the pension fund from a benefit-defined to a contribution-defined scheme in the positions of personnel expense and Group net income. In addition, the prior-year comparative figures were restated as a result of the spin-off of the trust and fiduciary companies completed in 2013 and do not agree with those reported in the 2012 financial statements.

Total operating income

Year-on-year, total operating income increased by 1.8 per cent from CHF 235.2 million to CHF 239.4 million. Interest income rose year-on-year by CHF 3.4 million to CHF 86.9 million. Net interest income from banks and customers recorded a decline of CHF 11.6 million in comparison to the prior year, which could be partially offset by interest-rate swaps. These interest-rate swaps are deployed to hedge interest-rate risk primarily on long-term client loans. As a result of an increasingly positive market sentiment and higher stock-exchange turnover, income from commissions and services increased by 5.6 per cent to CHF 114.1 million. Both net brokerage income with a growth of 12.4 per cent and asset-management and investment commissions with a growth of 4.7 per cent are a welcome increase over the prior year. In addition, commissions from the investment-fund business show an increase of CHF 3.2 million to CHF 56.1 million over the comparative prior-year figures (CHF 52.9 million).

Income from trading activities in 2013 declined by 7.7 per cent from CHF 22.1 million to CHF 19.5 million. Trading on behalf of clients increased by 9.3 per cent to CHF 24.9 million (prior year: CHF 22.7 million). Income from trading activities fell particularly as a result of revaluation losses on hedges for equity securities from CHF –1.6 million in the prior year to CHF –5.4 million in 2013. These changes in values arising from hedges are offset by revaluation gains/losses in the hedged underlying positions.

Gains from financial investments of CHF 16.3 million (prior year: CHF 19.5 million) were generated in 2013. The major part thereof results from revaluation gains on equity securities, on the one hand, and interest, on the other.

Money market

Interest – 3 months | 31/12/2013 | 31/12/2012 | ∆ previous year |

Swiss-franc LIBOR | 0.02% | 0.01% | +1 BP |

Euribor | 0.27% | 0.13% | +14 BP |

Dollar LIBOR | 0.25% | 0.31% | –6 BP |

Yen LIBOR | 0.15% | 0.18% | –3 BP |

Capital market

Benchmark bonds – | 31/12/2013 | 31/12/2012 | ∆ previous year |

Switzerland | 1.07% | 0.46% | +61 BP |

Germany | 1.93% | 1.30% | +63 BP |

USA | 3.03% | 1.75% | +128 BP |

Japan | 0.74% | 0.79% | –5 BP |

Forex rates

Exchange rates | 31/12/2013 | 31/12/2012 | ∆ previous year |

EUR | 1.2255 | 1.2068 | 1.5% |

USD | 0.8894 | 0.9154 | –2.8% |

JPY | 0.8462 | 1.0586 | –20.1% |

GBP | 1.4730 | 1.4879 | –1.0% |

Operating expenses

Thanks to consistent cost discipline, operating expenses fell by 1.5 per cent to CHF 168.0 million in the prior year, after adjusting for one-off items.

At the end of 2013, VP Bank Group had 706 (prior year: 707) employees, expressed as full-time equivalents. With the strategic refocusing on the middle private-banking segment, 32 employees were transferred from HSBC as part of the asset deal or were additionally recruited. On the other hand, 28 employees were transferred out to the trust and fiduciary companies sold as part of the strategic spin-off of the Group’s own trust and fiduciary entities.

Year-on-year, personnel expense rose by CHF 20.9 million, or 20.7 per cent to CHF 122.0 million. After adjusting in 2012 for the non-recurring impact of the conversion of the pension fund from a defined-benefit to a defined-contribution scheme as well as the early adoption of the revised standard IAS 19, personnel expense fell year-on-year by CHF 1.9 million, or 1.5 per cent. General and administrative expenses could be reduced in 2013 by 1.5 per cent from CHF 46.7 million to CHF 46.0 million. As a result of the HSBC asset deal and of expenses incurred in connection with the participation of VP Bank (Switzerland) Ltd. in the US tax programme, professional fees paid during the year rose from CHF 6.1 million to CHF 8.0 million.

The charge for valuation allowances, provisions and losses amounted to CHF 6.4 million (prior year: CHF 7.2 million). The reduction relates in particular to the decline in credit risks. In addition, no longer required valuation allowances of CHF 4.0 million (prior year: CHF 8.1 million) could be released to income. On the other hand, provisions for legal and litigation risks increased by CHF 2.3 million to CHF 3.3 million. CHF 3.0 million was accrued for a possible fine in connection with the participation of VP Bank (Switzerland) Ltd. in the US tax programme.

Group net income

Group net income, including income from discontinued operations, amounts to CHF 38.7 million (prior year: CHF 47.2 million). As a result of the simplification of the structure for VP Bank and Trust Company (BVI) Limited in Tortola, there are no longer any non-controlling interests in the Group as of 31/12/2013. The undiluted Group net income per bearer share fell from CHF 8.37 to CHF 6.58 during the 2013 reporting period. After adjusting for non-recurring items in 2012, an increase from CHF 4.42 to CHF 6.58 could be achieved.

Balance sheet

Total assets of CHF 11.2 billion increased by 5.3 per cent year-on-year. On the assets’ side, cash and cash equivalents increased markedly to CHF 1,377.4 million (31/12/2012: CHF 927.0 million), which constitutes a very comfortable liquidity level of VP Bank. This is to be ascribed, inter alia, to the reduction of amounts due from banks (minus CHF 287.0 million) and additional amounts due to clients on the liabilities’ side amounting to CHF 9.6 billion (prior year: CHF 9.0 billion).

As a result of the current situation on the real-estate market and ongoing low interest rate period, VP Bank continues to focus on qualitative growth in customer loans and on a high level of discipline and control over credit granting. Since the beginning of 2013, loans to customers have risen by CHF 213.4 million to CHF 3.9 billion, whereby mortgage loans recorded an increase of 5.7 per cent to CHF 2.8 billion.

Financial instruments valued at amortised cost increased by CHF 273.6 million from CHF 502.6 million in the prior year to CHF 776.2 million in 2013 (plus 54.5 per cent).

Consolidated shareholders‘ equity at the end of 2013 amounted to CHF 888.7 million (end of 2012: CHF 888.8 million). As VP Bank no longer has any non-controlling interests, this amount corresponds to the equity resources of Verwaltungs- und Privat-Bank Aktiengesellschaft. In the prior year, shareholders’ equity, after deducting non-controlling interests, stood at CHF 871.1 million. As of 31 December 2013, the tier 1 ratio was 20.4 per cent (prior year: 21.5 per cent).

Outlook

The capital market environment remains challenging. After considerable gains in almost all asset classes during recent years, individual investment categories should develop in differing directions. Interest income on debentures will be influenced by the increase in yields. Equity values are no longer cheap and further gains will be achieved at the price of increased volatility. The continuing scarcity of investment opportunities as well as monetary policies will also greatly influence market developments in future.

The process of transformation in the areas of tax transparency as well as the automatic exchange of tax information are developments which will be of great concern to VP Bank in the coming years. The pressure from regulators in the finance sector will continue unabated at a high level. VP Bank Group is well equipped for intensive competition. It responds to the demands with concrete measures and is continuing on the path to a successful future without deviation.

Money market

Interest – 3 months | 31/12/2013 | 31/12/2012 | ∆ previous year |

Swiss-franc LIBOR | 0.02% | 0.01% | +1 BP |

Euribor | 0.27% | 0.13% | +14 BP |

Dollar LIBOR | 0.25% | 0.31% | –6 BP |

Yen LIBOR | 0.15% | 0.18% | –3 BP |

Capital market

Benchmark bonds – 10 years | 31/12/2013 | 31/12/2012 | ∆ previous year |

Switzerland | 1.07% | 0.46% | +61 BP |

Germany | 1.93% | 1.30% | +63 BP |

USA | 3.03% | 1.75% | +128 BP |

Japan | 0.74% | 0.79% | –5 BP |

Forex rates

Exchange rates | 31/12/2013 | 31/12/2012 | ∆ previous year |

EUR | 1.2255 | 1.2068 | 1.5% |

USD | 0.8894 | 0.9154 | –2.8% |

JPY | 0.8462 | 1.0586 | –20.1% |

GBP | 1.4730 | 1.4879 | –1.0% |