Clients

VP Bank pursues a client-oriented business strategy. Closeness to the customer is a key factor in client care because it is the only way to understand and respond to the latest developments in the market. Again in 2012, VP Bank invested extensively in direct client contact.

A clear definition of the roles involved in client care regulates the interplay between front-office relationship managers and people behind the scenes, such as specialists for securities, tax matters, credits, investment funds and trusts. Within the framework of a holistic approach to advising clients, these teams call on competencies throughout VP Bank Group in order to arrive at individualised solutions that meet the broadest spectrum of requirements.

Moreover, this advisory concept embraces all phases in the lifecycle of a client, and differentiation enables the Bank to offer a tailor-made range of financial products and services. VP Bank Group is the provider of choice for individualised portfolio management and investment advice that meet the needs of private individuals and financial intermediaries. Thanks to the Bank’s principle of open architecture, clients benefit from truly unbiased advice. Included in the recommendations are best-in-class products and services of third-party financial institutions as well as the Bank’s own investment solutions.

VP Bank focuses intently on client satisfaction and service quality, and thus regularly conducts surveys as a part of its client feedback management activities. Open feedback channels, professional complaint handling, and an ongoing dialogue with clients are evidence of this resolute orientation towards client needs and concerns.

Business units and client segments

With its Private Banking and Intermediaries business units, VP Bank addresses a predefined and limited number of target markets and client segments. In this connection, it differentiates between target markets in the vicinity of the Bank’s booking centres and other markets that lie outside those areas. Private banking services and support to financial intermediaries are offered at all locations of VP Bank throughout the world, while in Liechtenstein and the surrounding region the palette is supplemented by retail banking services that include client-oriented package solutions.

In Liechtenstein as well as eastern Switzerland, VP Bank also caters to the needs of institutional and regional corporate clients by facilitating the finan- cing of investments and operating capital. In particular, the younger target groups are addressed via e-channel initiatives. Youth packages for students and apprentices round off the array of services.

The Private Banking unit concentrates on the mid-range segment with total assets of CHF 1 million to 25 million. Segmentation is accomplished according to the benefit preferences of clients by means of targeted offerings.

Advisory process

For optimal client care, VP Bank conducts a five-stage advisory process.

1. Win the client

The prerequisites for successful client acquisition are systematic planning, preparation and execution, whereas VP Bank wins most of its new clients as a result of recommendations by existing clients.

2. Understand the client

Understanding the client represents the basis for providing professional advice. The quality and quantity of information received from the client through direct questioning or in written form are decisive factors in the ability to identify the client’s needs and to develop fine-tuned solutions.

3. Advise the client

Once the needs of the client have been determined, solutions that reflect various scenarios and alternatives need to be presented. The client is not only shown the solutions that are “the closest fit”, but also sensible possibilities in a broader context. VP Bank attaches great value to a team approach in arriving at solutions. Accordingly, specialists as well as other sources of know-how are called upon in this process.

4. Implement the client’s wishes

If the client agrees with the proffered solution, implementation is the next step. The time taken for translating solutions into reality underscores VP Bank’s devotion to achieving the exceptional. VP Bank considers it extremely important that the implementation of solutions is conducted in a timely manner or in keeping with agreed milestones that fulfil the needs of the client.

5. Accompany the client

The advisory process does not end merely upon realisation of the solution. A client profile changes steadily and is augmented to reflect new developments. By periodically comparing the client profile with the effects and performance of a previously agreed solution, genuine added value is generated for the client.

Client assets

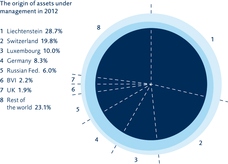

As at 31 December 2012, VP Bank held client assets under management totalling CHF 28.5 billion (3.9 per cent more than in the previous year). In addition, CHF 8.8 billion were in the form of assets held in custody. Thus total client assets on that date amounted to CHF 37.3 billion.